Local Market Update – April 2021

Despite a bump in new listings the supply of homes still can’t keep up with the demand. The result? Multiple offers, escalation clauses, and record-breaking prices. If you’re considering selling your home, you’d be hard pressed to find a more lucrative market than what we have today.

March marked the first post-COVID/pre-COVID comparison, and the results were dramatic.

The drop in the number of listings was profound. In King County there were 54% fewer single-family homes on the market at the end of March than the same time a year ago. The Eastside had 68% fewer listings. There were just 216 homes for sale on the Eastside, which stretches from Issaquah to Woodinville. Extensive new investments there, including Amazon’s plan to add 25,000 jobs in Bellevue, will only increase demand for housing. North King County, which includes Richmond Beach and Lake Forest Park had just 26 homes for sale. In Seattle, the 498 listings there represents a drop of 18% from a year ago. Despite the comparatively greater number of listings, Seattle still has only two weeks of available inventory. The situation was even more dire in Snohomish County. With the number of homes for sale down 68%, the county has just one week of inventory.

So why is inventory so low? The pandemic certainly has played a part. People now working from home have bought up properties with more space in more desirable locations. Nervousness and uncertainty about COVID compelled many would-be sellers to postpone putting their home on the market. Downsizers who may have moved into assisted living or nursing homes are staying in place instead. But there are other factors as well.

For more than a decade, less new construction has been built relative to historical averages, particularly in the suburbs. Interest rates have also been a factor. Windermere Chief Economist Matthew Gardner noted, “I think a lot of the urgency from buyers is due to rising mortgage rates and the fear that rates are very unlikely to drop again as we move through the year, which is a safe assumption to make.” Homeowners who refinanced when rates were at record lows are staying in their homes longer, keeping more inventory off the market. And those same low interest rates have compelled many homeowners who bought a new home not to sell their previous one, but to keep it as a rental property.

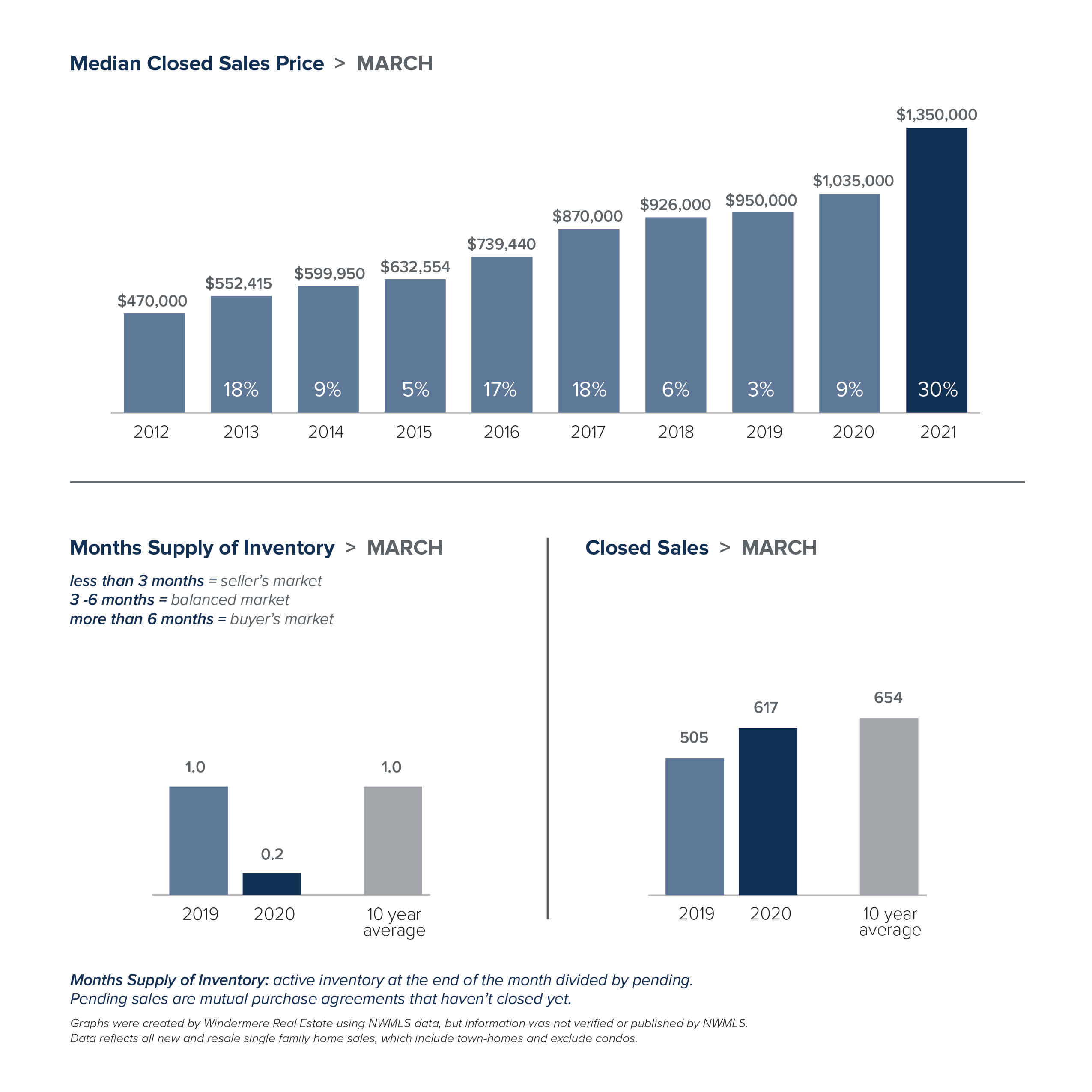

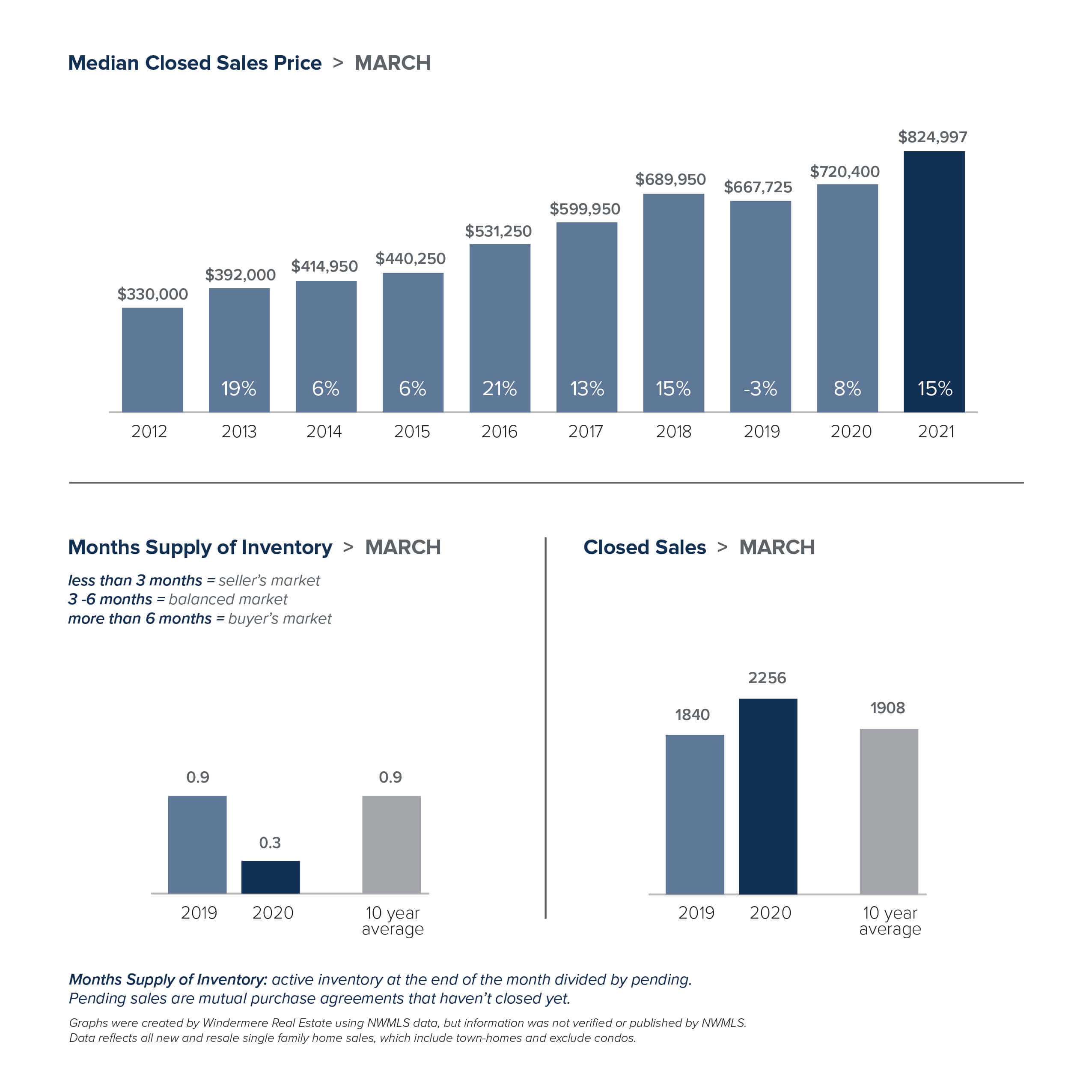

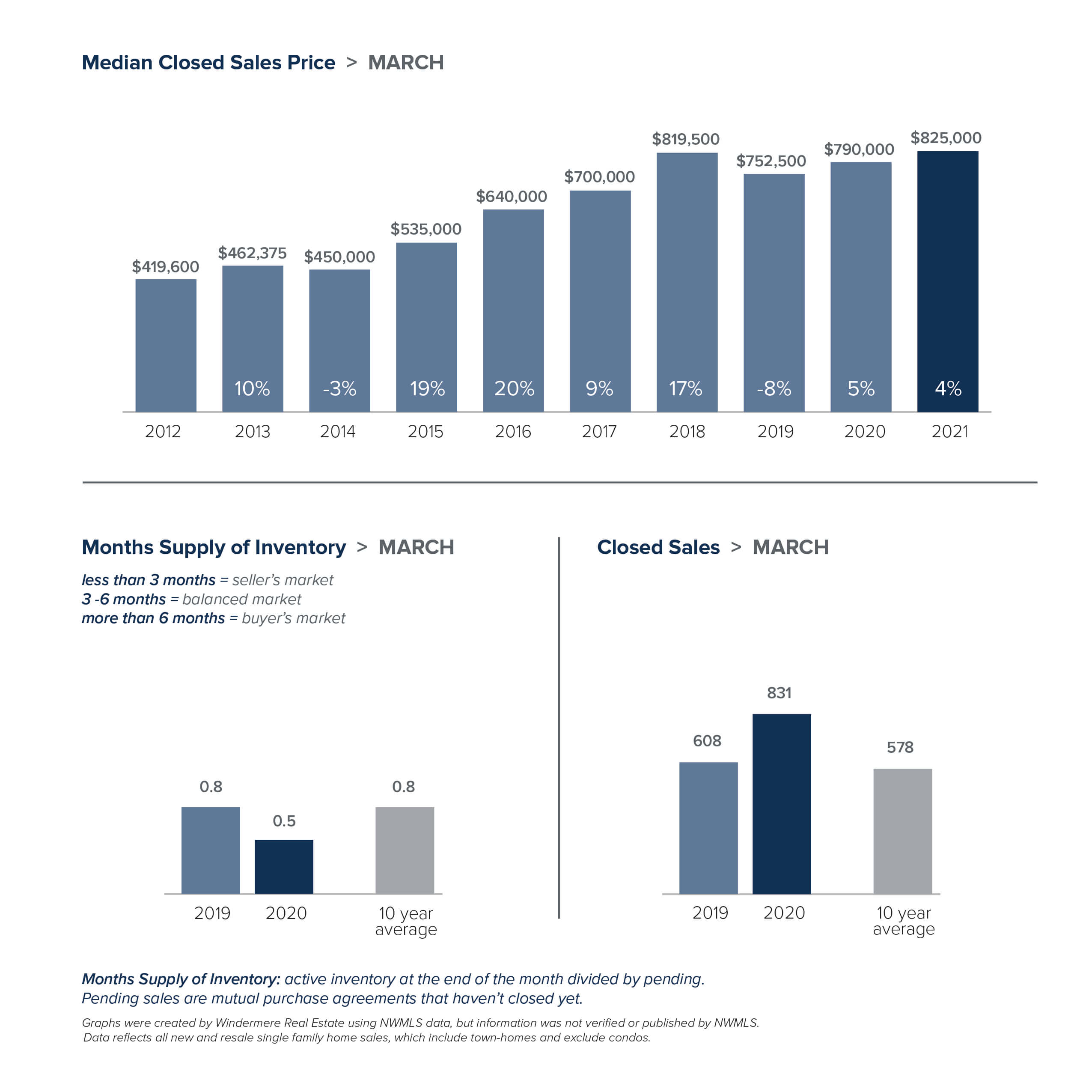

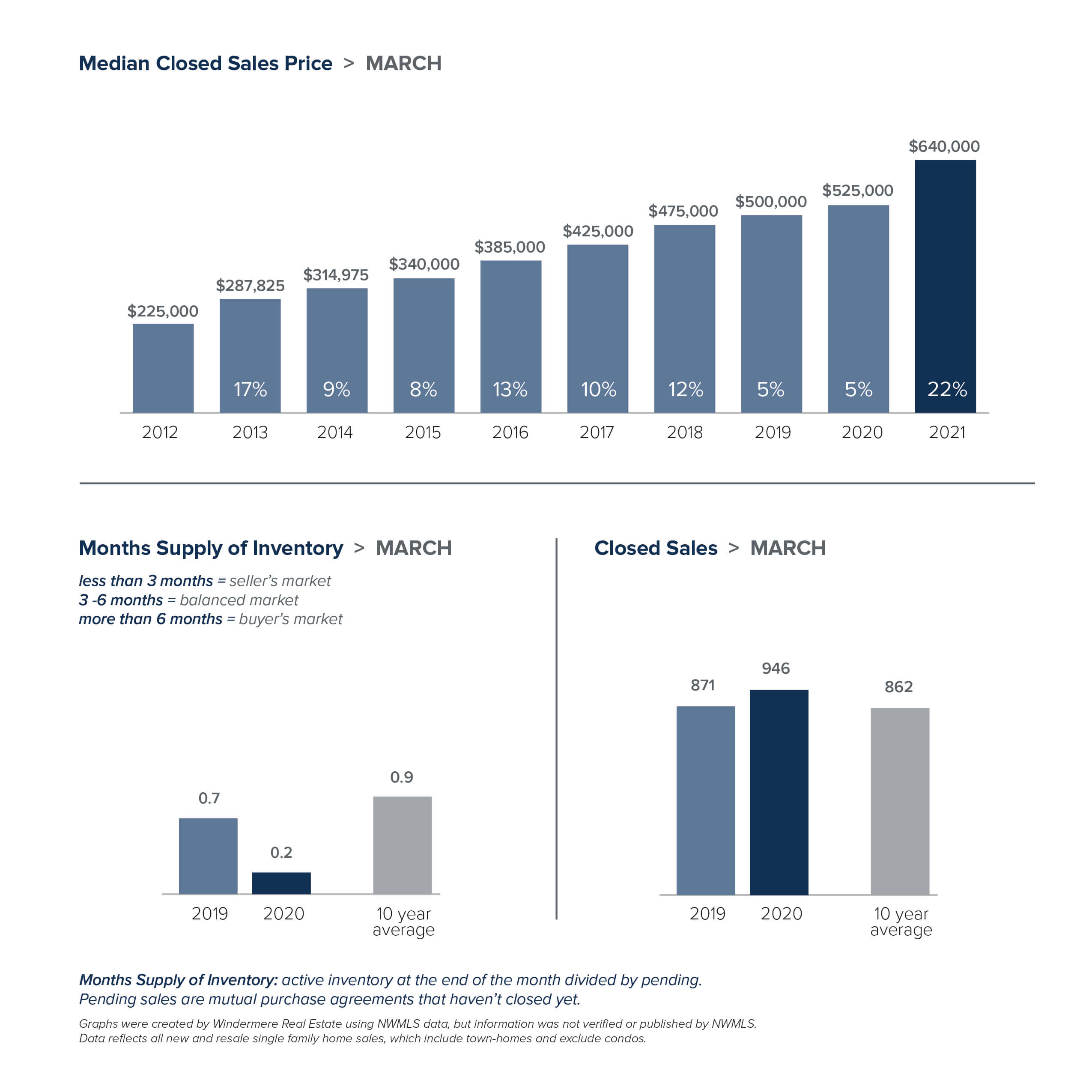

While the number of listings tanked, the number of sales skyrocketed. That’s the recipe for soaring home prices. Housing prices here have been growing at the second-fastest rate in the nation for a full year. Nearly every area of King County saw double-digit price increases, with the exception of Seattle. In King County the median price for a single-family home in March was a record-high $825,000, up 15% from a year ago and an increase of 10% from February. The median home price topped $1 million for every city on the Eastside, where the overall median price surged 30% to $1,350,000, the highest median price ever recorded for the area. Seattle homes prices were also record-breaking, rising 4% to $825,000. Snohomish County prices set yet another all-time high as the median home price jumped 22% to $640,000.

The appeal of our area just keeps growing. For the second time, Washington took the No. 1 spot in the U.S. News Best States ranking – the first state to earn the top ranking twice in a row. The bottom line: the local real estate market is extremely competitive, and it shows no signs of slowing down. Successfully navigating today’s market takes a strong plan. Your broker can work with you to determine the best strategies for your individual situation.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GettheWReport.com

Washington Ranked Best State in the Nation, Again

Once again, Washington has been ranked as the best state in the country, according to a new report from U.S. News and World Report. The Evergreen State has held the honor since 2019, based on its strength in categories like education, healthcare and broadband access.

Washington rank first for GDP growth and broadband access, and is tied for first when it comes to government credit rating scores. Our state is third for infrastructure, and in the top ten for economy.

In healthcare, our state ranks 8th overall, with only 9.5% of the population without health insurance — lower than the national average of 12.9%. We also have a lower obesity rate of only 28.3%, compared to 32.1% nationally.

In education, Washington graduates finish school with about $4,000 less debt than their peers in other states. Overall, the state ranks second for higher education. Washington’s high school graduation rate of 86.7% also beats the national average of 85.3%.

After Washington, the report ranked Minnesota second and Utah third. Mississippi and Louisiana bring up the rear, at numbers 49 and 50, respectively.

While Washington was ranked first overall, our state definitely still has areas for improvement. Washington’s lowest ranking was 25th place for affordability, and within that category it was ranked 44th for the cost of daily life and housing.

Although there are some areas to improve on, there’s definitely a reason so many people enjoy life here in the Evergreen State. With a little work, hopefully Washington will continue to defend its title as the best state in the nation.

This article was originally posted on King 5 and GettheWReport

Local Market Update – March 2021

Neither the snowstorm nor the increase in mortgage rates dampened buyer demand in February. Lack of inventory continues to be a frustration as there are way more prospective buyers than there are homes for them to buy. As a result, prices continued their upward climb.

While the number of homes for sale edged up, it was still far shy of demand. This is especially true of single-family homes. There were 41% fewer homes on the market in King County in February than the same time last year. In an indication of just how competitive the current market is, the entire Eastside ended the month with just 224 homes for sale. Inventory was even more scarce in Snohomish County where the entire county had just 283 homes for sale, a drop of 58% from a year ago. Condo shoppers have more options as the number of units on the market in King County increased 56% from last February.

With inventory so slim, competition is fierce. 57% of King County properties that sold in February sold over the list price. The median sale price paid was 9% over list price. Both are record highs. Competition doesn’t show signs of easing any time soon. A hike in interest rates is expected to only increase buyer urgency. An average rate of 3.02% for a 30-year fixed-rate mortgage for the week ending March 4 is the first time since July that the benchmark mortgage rate climbed above 3%.

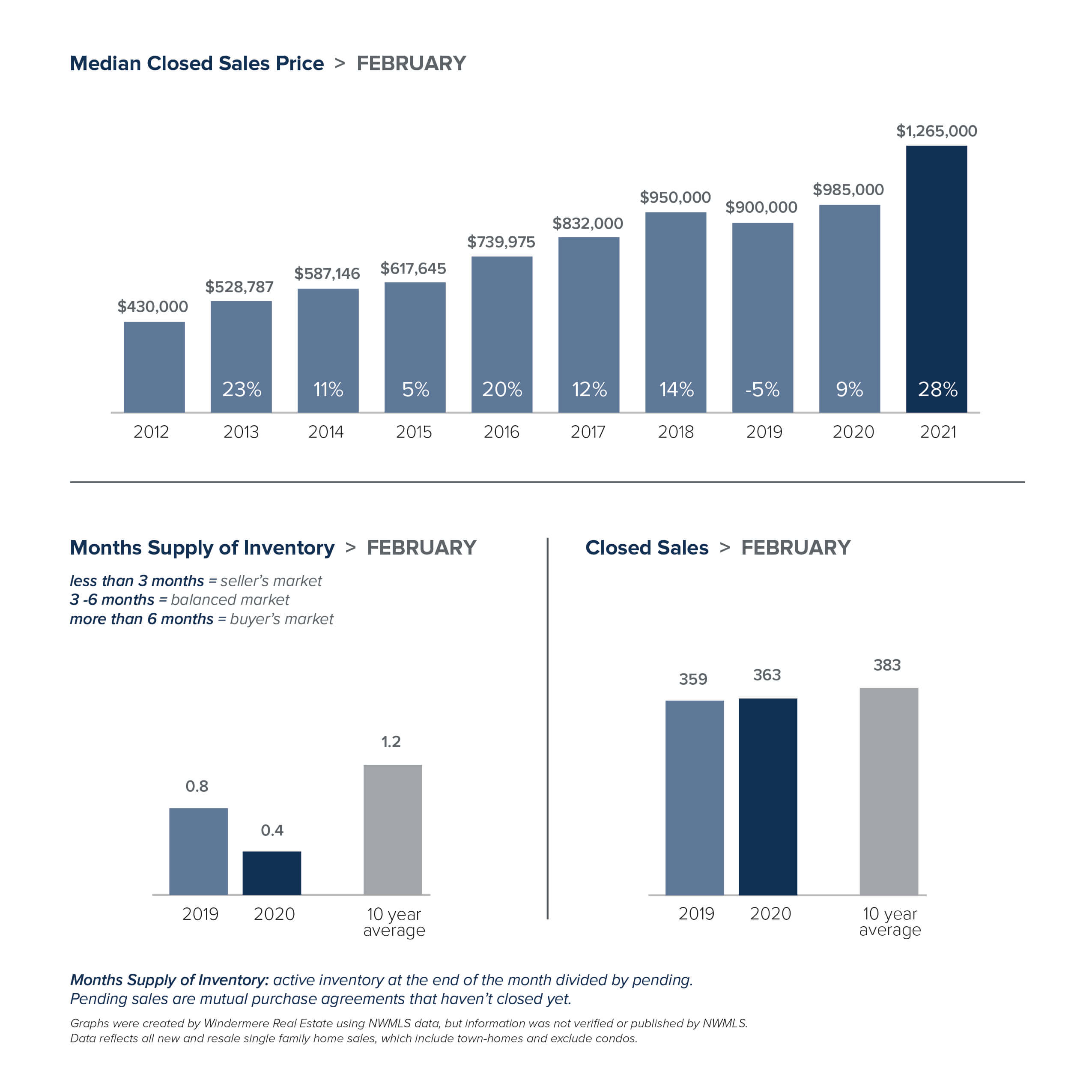

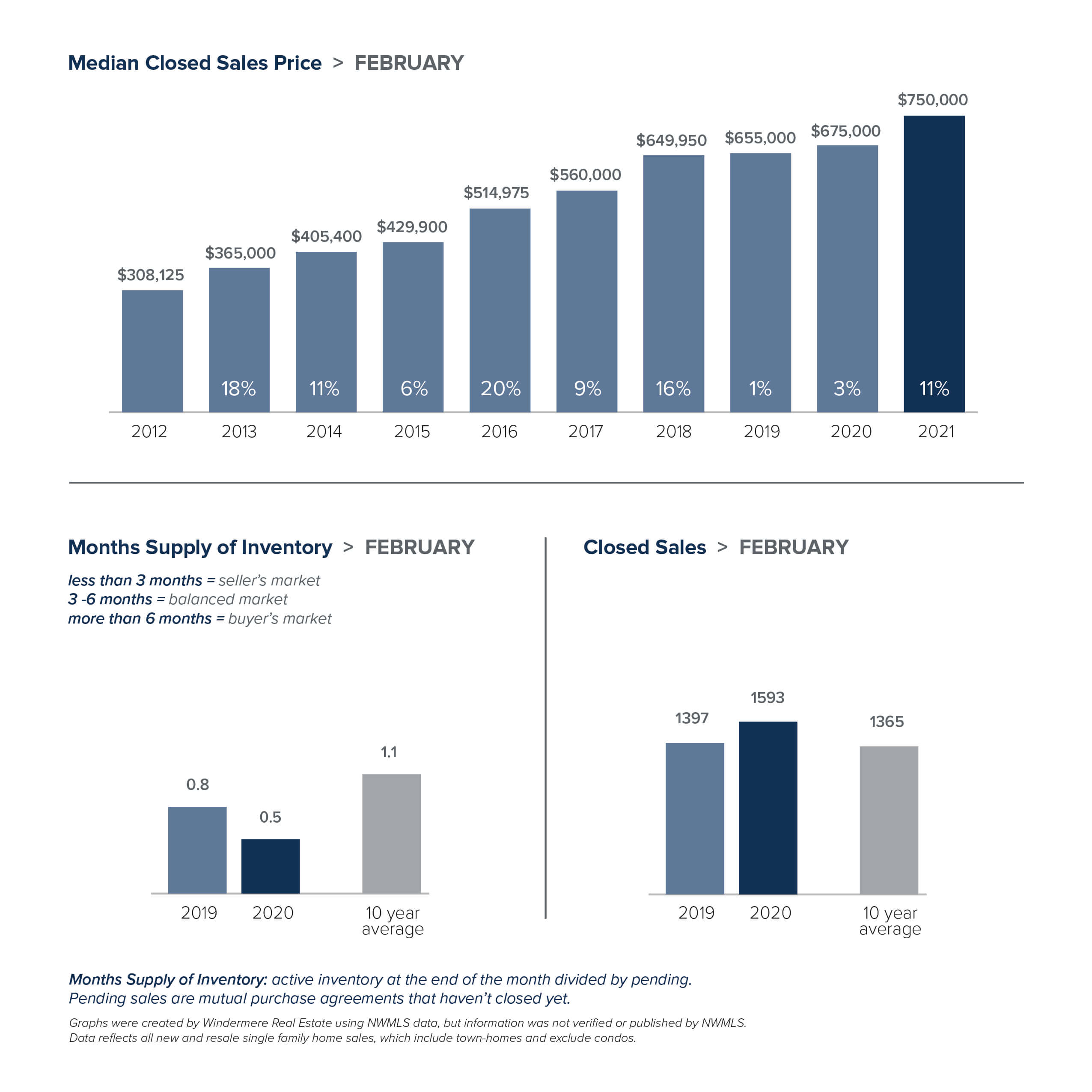

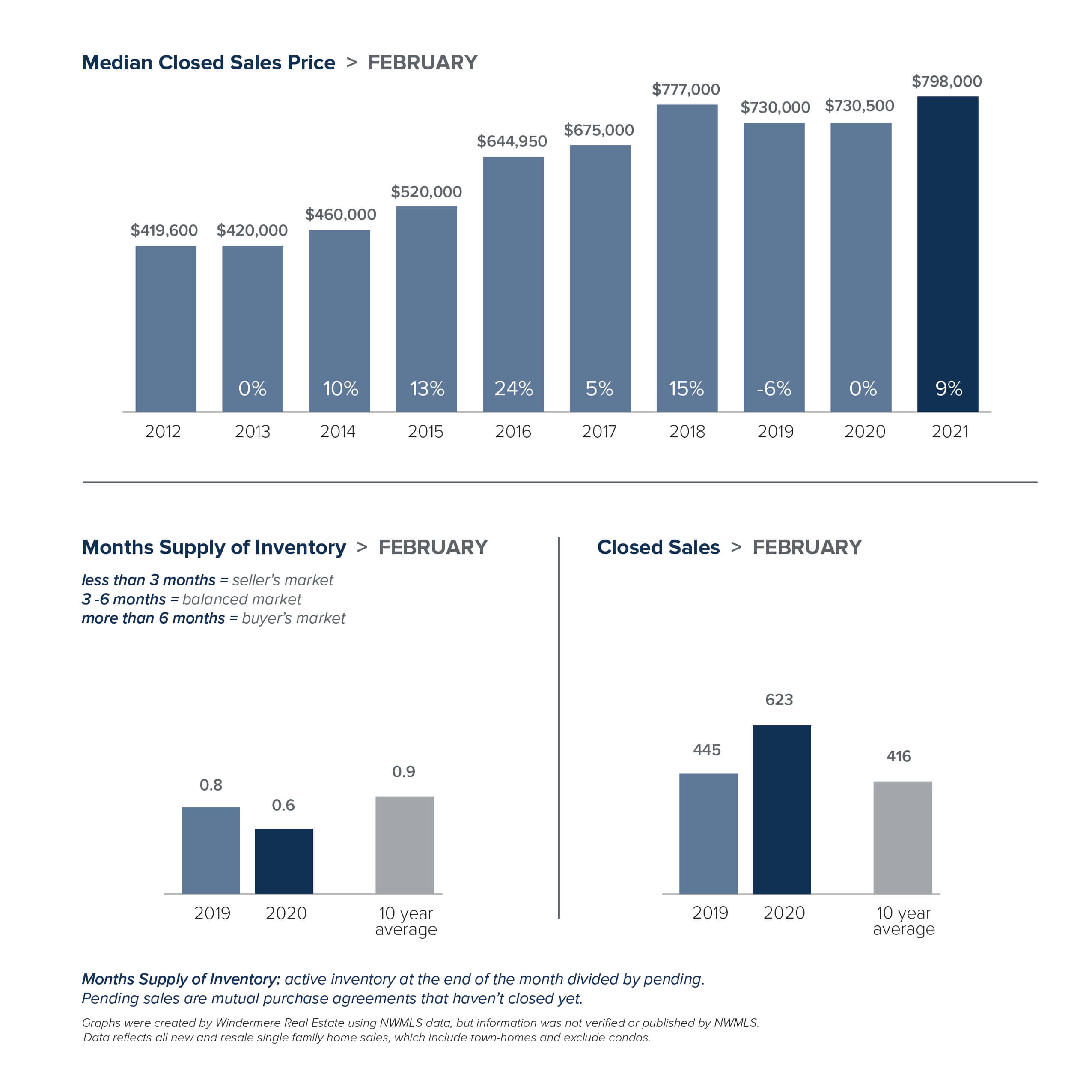

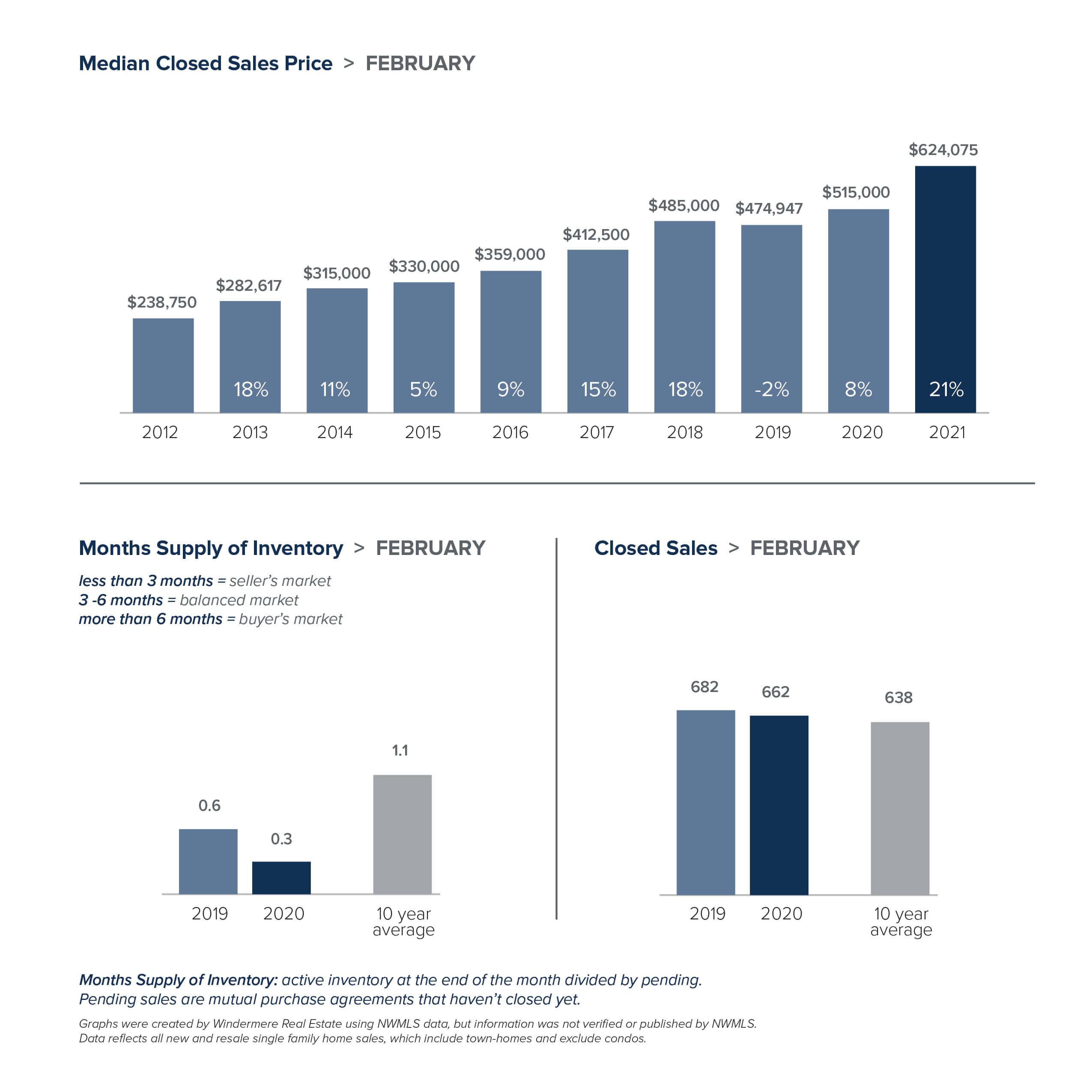

The enormous imbalance between supply and demand sent single-family homes prices soaring throughout the region. In King County, the median home sold for $750,000, 11% higher than a year ago. Most areas in the county saw double-digit increases. Home prices on the Eastside jumped a whopping 28%. Seattle home prices were up 9%. In Snohomish County, the February $624,075 median price was up 21% from a year earlier and far surpassed the previous all-time high of $599,990 set in January.

With seller review dates, escalation clauses and multiple offers now the norm it’s more important than ever for buyers to work with their broker to create a strategy that balances their wants and needs with their budget.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Q4 2020 Western Washington Real Estate Market Update

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me!

REGIONAL ECONOMIC OVERVIEW

After the COVID-19-induced declines, employment levels in Western Washington continue to rebuild. Interestingly, the state re-benchmarked employment numbers, which showed that the region lost fewer jobs than originally reported. That said, regional employment is still 133,000 jobs lower than during the 2020 peak in February. The return of jobs will continue, but much depends on new COVID-19 infection rates and when the Governor can reopen sections of the economy that are still shut down. Unemployment levels also continue to improve. At the end of the quarter, the unemployment rate was a very respectable 5.5%, down from the peak rate of 16.6% in April. The rate varies across Western Washington, with a low of 4.3% in King County and a high of 9.6% in Grays Harbor County. My current forecast calls for employment levels to continue to improve as we move through the spring. More robust growth won’t happen until a vaccine becomes widely distributed, which is unlikely to happen before the summer.

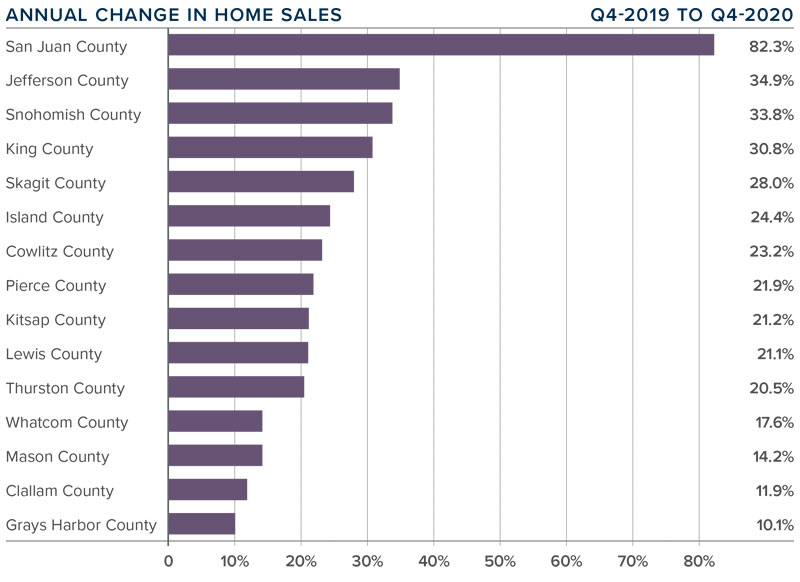

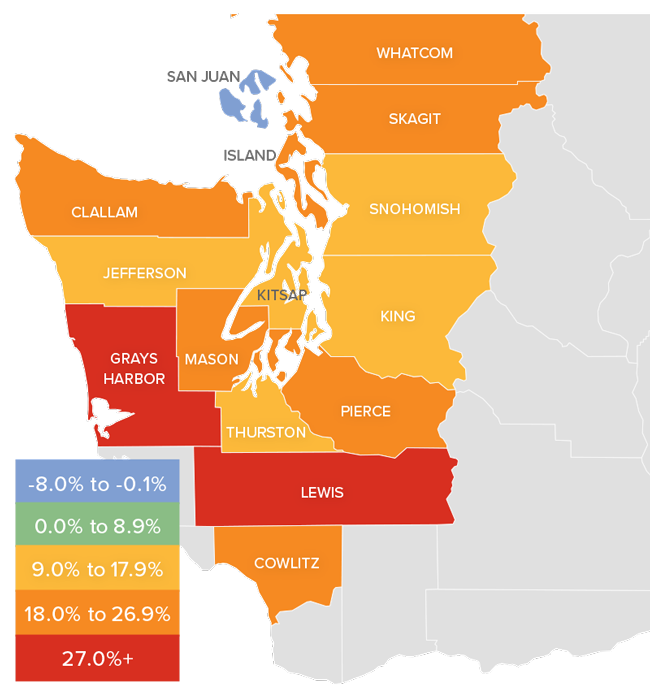

WESTERN WASHINGTON HOME SALES

❱ Sales continued to impress, with 23,357 transactions in the quarter. This was an increase of 26.6% from the same period in 2019, but 8.3% lower than in the third quarter of last year, likely due to seasonality.

❱ Listing activity remained very low, even given seasonality. Total available inventory was 37.3% lower than a year ago and 31.2% lower than in the third quarter of 2020.

❱ Sales rose in all counties, with San Juan County seeing the greatest increase. This makes me wonder if buyers are actively looking in more remote markets given ongoing COVID-19 related concerns.

❱ Pending sales—a good gauge of future closings—were 25% higher than a year ago but down 31% compared to the third quarter of 2020. This is unsurprising, given limited inventory and seasonal factors.

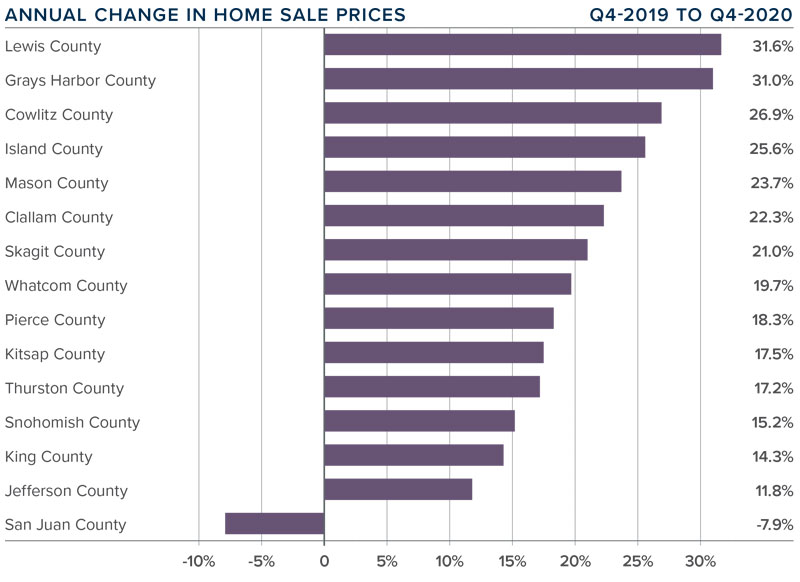

WESTERN WASHINGTON HOME PRICES

❱ Home price growth in Western Washington continued the trend of above-average appreciation. Prices were up 17.4% compared to a year ago, with an average sale price of $617,475.

❱ Year-over year price growth was strongest in Lewis and Grays Harbor counties. Home prices declined in San Juan County which is notoriously volatile because of its small size.

❱ It is interesting to note that home prices were only 1% higher than third quarter of 2020. Even as mortgage rates continued to drop during the quarter, price growth slowed, and we may well be hitting an affordability ceiling in some markets.

❱ Mortgage rates will stay competitive as we move through 2021, but I expect to see price growth moderate as we run into affordability issues, especially in the more expensive counties.

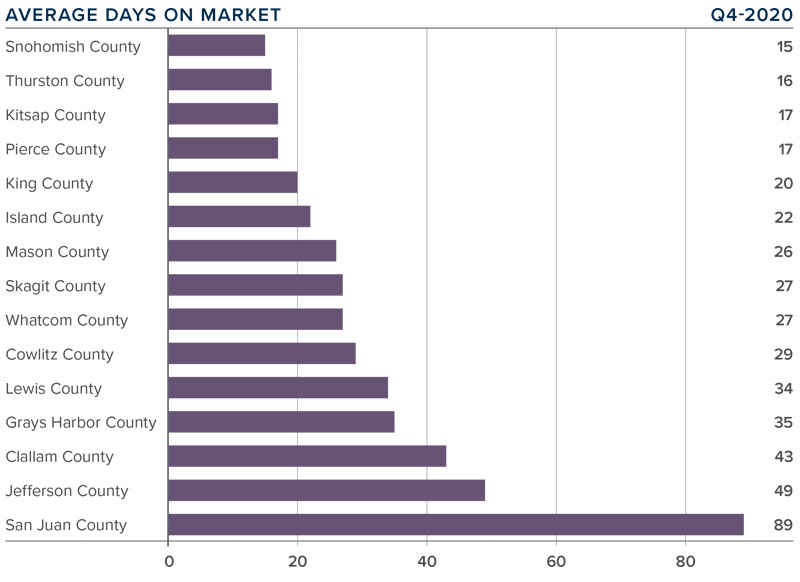

DAYS ON MARKET

❱ 2020 ended with a flourish as the average number of days it took to sell a home in the final quarter dropped by a very significant 16 days compared to a year ago.

❱ Snohomish County was again the tightest market in Western Washington, with homes taking an average of only 15 days to sell. The only county that saw the length of time it took to sell a home rise compared to the same period a year ago was small Jefferson County, but it was only an increase of four days.

❱ Across the region, it took an average of 31 days to sell a home in the quarter. It is also worth noting that, even as we entered the winter months, it took an average of five fewer days to sell a home than in the third quarter of last year.

❱ The takeaway here is that demand clearly remains strong, and competition for the few homes available to buy continues to push days on market lower.

CONCLUSIONS

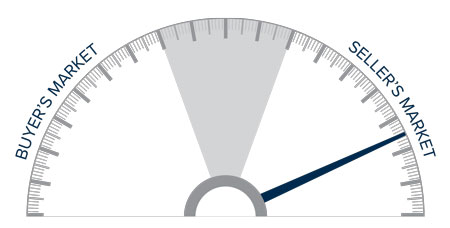

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Demand has clearly not been impacted by COVID-19, mortgage rates are still very favorable, and limited supply is causing the region’s housing market to remain incredibly active. Because of these conditions, I am moving the needle even further in favor of sellers.

2021 is likely to lead more homeowners to choose to move if they can work from home, which will continue to drive sales growth and should also lead to more inventory. That said, affordability concerns in markets close to Western Washington’s job centers, in combination with modestly rising mortgage rates, should slow the rapid home price appreciation we have seen for several years. I, for one, think that is a good thing.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog

Local Market Update – January 2021

The end of 2020 marked a most unusual year, and the real estate market was no exception. While homes sales usually take a holiday during December, this year saw the continuation of an exceptionally strong and competitive market. New listings, closed sales and home prices all went up. With supply nowhere close to meeting demand, the strong market is expected to extend into 2021.

Inventory continues to be the biggest challenge for buyers. While King County had a 62% increase in new listings compared to a year ago, homes were snapped up quickly, leaving the county with just over two weeks of available inventory at the end of the month. The supply of single-family homes was down 35% year-over-year. Buyers considering a condo had far more choices. Inventory was up 45%, but at about five weeks of available units the condo market is still significantly short of the four month supply that is considered balanced. Inventory in Snohomish County was even more strained, with the month end showing only a one-week supply of homes. At the end of December there were only 373 homes on the market in all of Snohomish County, a 63% drop from a year ago. With inventory this tight, it’s more important than ever for buyers to work with their agent on a strategic plan for getting the home they want.

Low inventory and high demand continued to push prices upward. The median single-family home price in King County was up 10% over a year ago to $740,000. Price increases varied significantly by area. Seattle home prices were up 10%. The traditionally more affordable area of Southwest King County, which includes Federal Way and Burien, saw prices jump 15%. And on the Eastside, the most expensive market in King County, home prices soared 17% — the largest increase of any area in the county. Home prices in Snohomish County rose 12% to $573,495, just shy of its all-time high of $575,000.

With 2021 ushering in a new record low for interest rates, and inventory at its tightest in recent memory, 2021 is expected to remain a very competitive market.

Windermere Chief Economist Matthew Gardner’s prediction: “As we move into 2021, I expect continued strong demand from buyers, but unfortunately, the likelihood that there will be any significant increase in inventory is slim. As a result, I believe prices will continue to rise, which is good news for sellers, but raises concerns about affordability. This, combined with modestly rising mortgage rates, could end up taking some steam out of the market but overall, I expect housing to continue being a very bright spot in the Puget Sound economy.”

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Seattle Ranked as Most Competitive Market in the Country

In news that won’t surprise anyone who’s tried to buy a home in Seattle in the last few months, the Emerald City has recently been ranked as the single most competitive market in the country. The study, released by Lombardo Homes, places Seattle first, followed closely behind by Omaha, Nebraska and Lexington, Kentucky.

According to the study, in Seattle 71% of listed homes are off the market within two weeks, spending a median of just 10 days on the market. In Omaha and Kentucky, 67% of homes are off the market within two weeks, spending a median of 13 and 15 days on the market, respectively.

The West coast at large is a hotbed of competition, with Portland coming in at number 6 in the ranking, followed by Sacramento and Oakland at numbers 8 and 9, respectively.

The study also suggests that buyers feel the market competition has actually increased since the pandemic began, with an average of 3 out of 4 buyers reporting having seen a home go off the market before they’ve had a chance to look at it.

The study revealed that 73% of buyers had to compete in multiple offer situations, and 73% had a home close before they could view it or make an offer. Interestingly, 53% of buyers also said the pandemic has caused them to accelerate their plans to buy a house.

Among the things buyers are most looking for in a home, Lombardo’s study indicated that the top consideration for buyers in October was the location of the home, as opposed to the home’s price, as indicated in a May survey. Buyers are now also considering kitchen size and room size as top features, whereas floor plan and storage space were more important in May.

One in three buyers also said home office space was their most important consideration in 2020. About 82% of buyers said they would go over budget for their perfect home during the pandemic, but 63% had to lower their overall budget due to the pandemic.

With the intense competition in mind, for buyers to get most everything they want they should be prepared to pounce on the right home when it comes up. Given how much time we’re spending indoors these days, home might be more important than ever.

This article was originally posted on Seattle P-I by Becca Savransky, and on GettheWReport.com

Local Market Update – December 2020

Nothing about 2020 is normal, and that includes real estate trends. The housing market typically slows significantly during the holiday season, but that is not the case this year. Buyer interest is strong, sales are up, and prices have followed suit.

A recent report ranked our area as the most competitive real estate market in the country, with 71% of homes selling within two weeks. While the number of new listings in November were up compared to a year ago, there just wasn’t enough inventory to meet the current surge in demand.

In King County there were 37% fewer single-family homes on the market – 1,621 homes this November vs. 2,592 a year ago. Inventory in Snohomish County is even more strained. At the end of the month there were just 416 homes for sale as compared to 1,204 a year ago, a 65% drop. Both counties had about a two week supply of homes at the end of November. A four month supply of inventory is considered balanced. Buyers in the market for a condominium in King County had much more options. Condo inventory was up 39% over last year.

The inventory-starved market sent home prices higher. The median single-family home price in King County was up 10% over a year ago to $730,500. Home prices in Snohomish County rose 14% to $566,000. In a survey of homebuyers looking for a home during Covid-19, 82% said they would go over budget to get their ideal home. Record-low interest rates have helped soften the blow of soaring prices a bit. According to Freddie Mac, rates on a 30-year fixed-rate mortgage fell to their lowest level, at 2.71%, for the 14th time this year.

With low inventory and high demand, buyers need to be ready to compete. That means being pre-approved or willing to offer cash, and working with an agent on a plan that includes counter-offers, escalation clauses and other strategies to help win the sale. As many consider working remotely long-term, our home has become more important to us than ever.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Local Market Update – November 2020

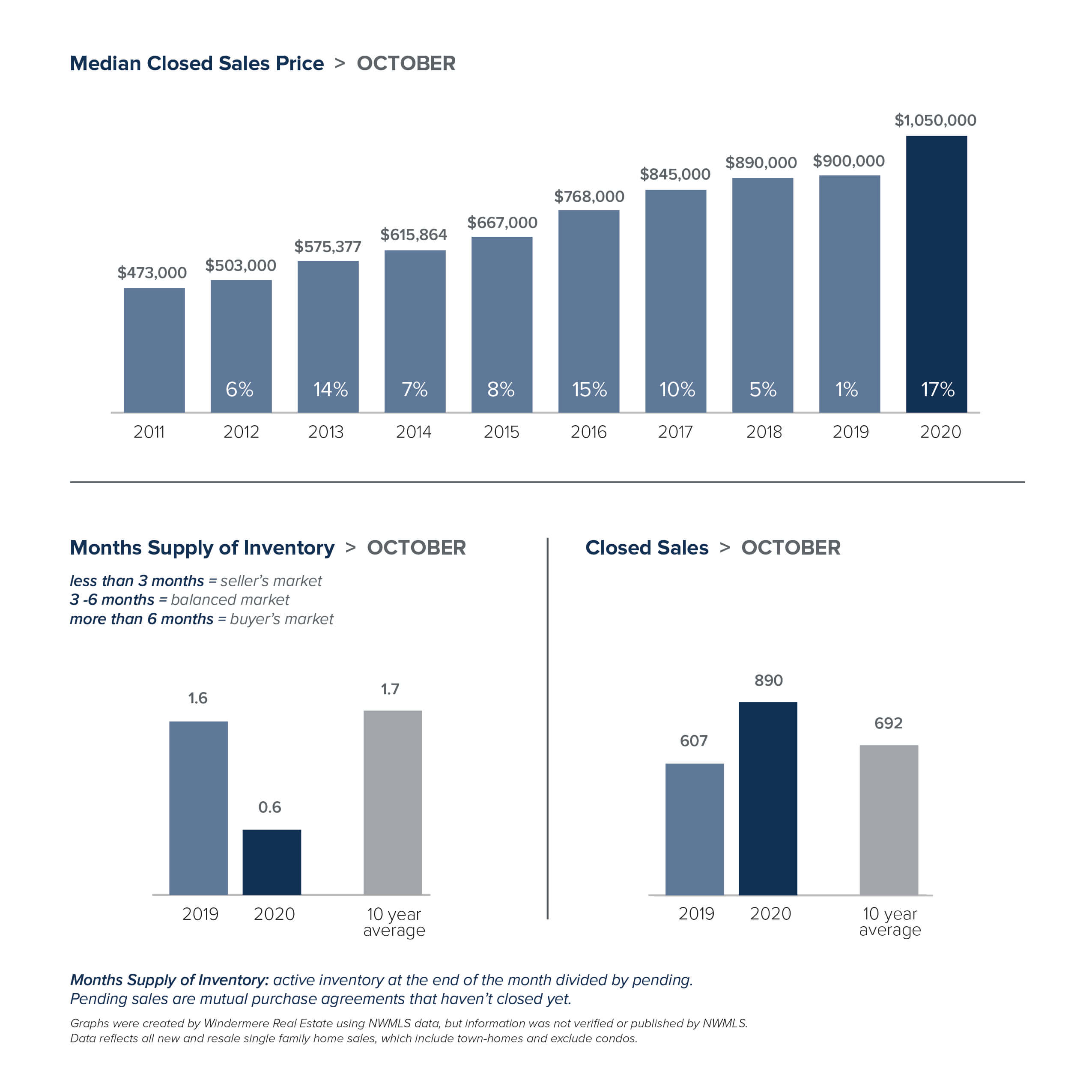

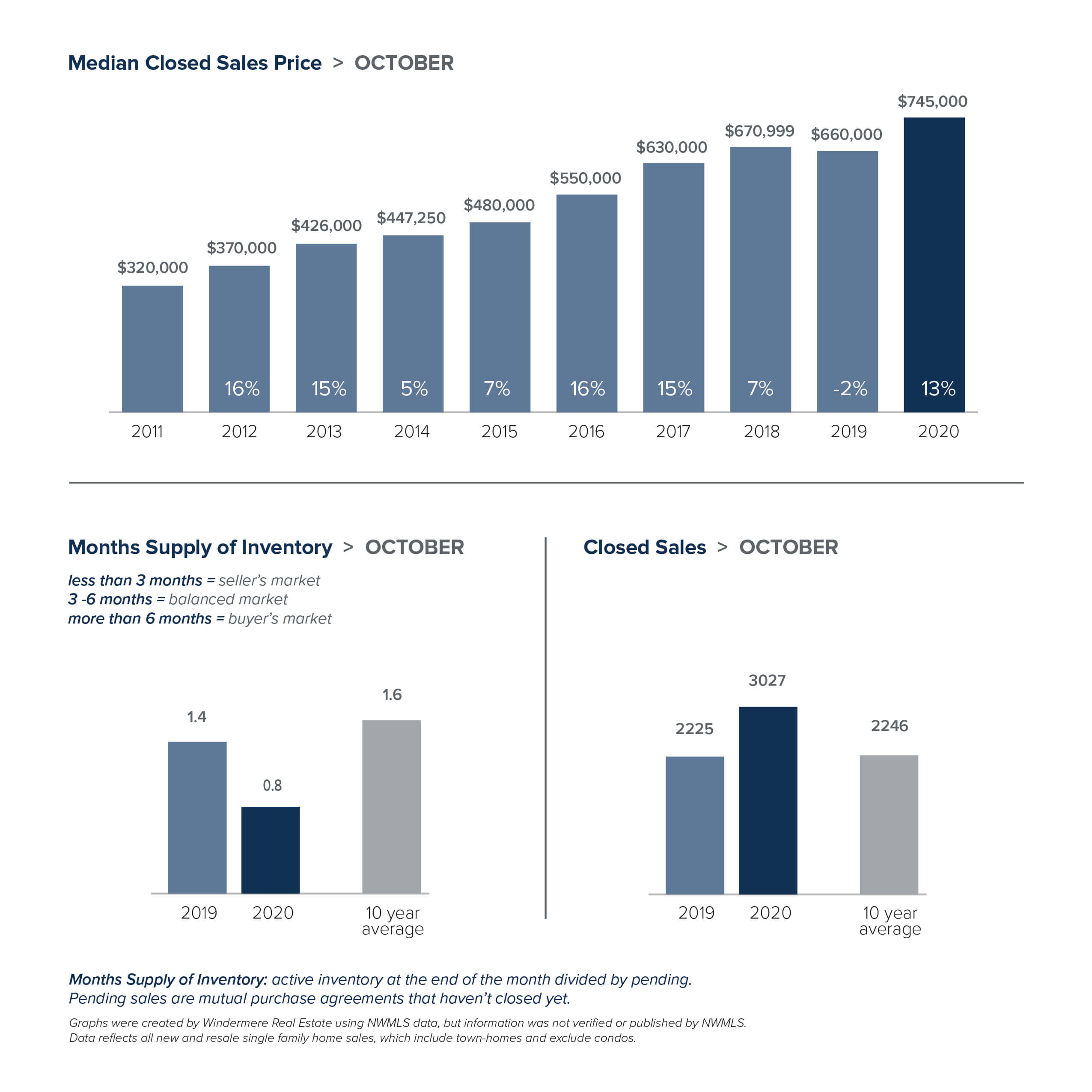

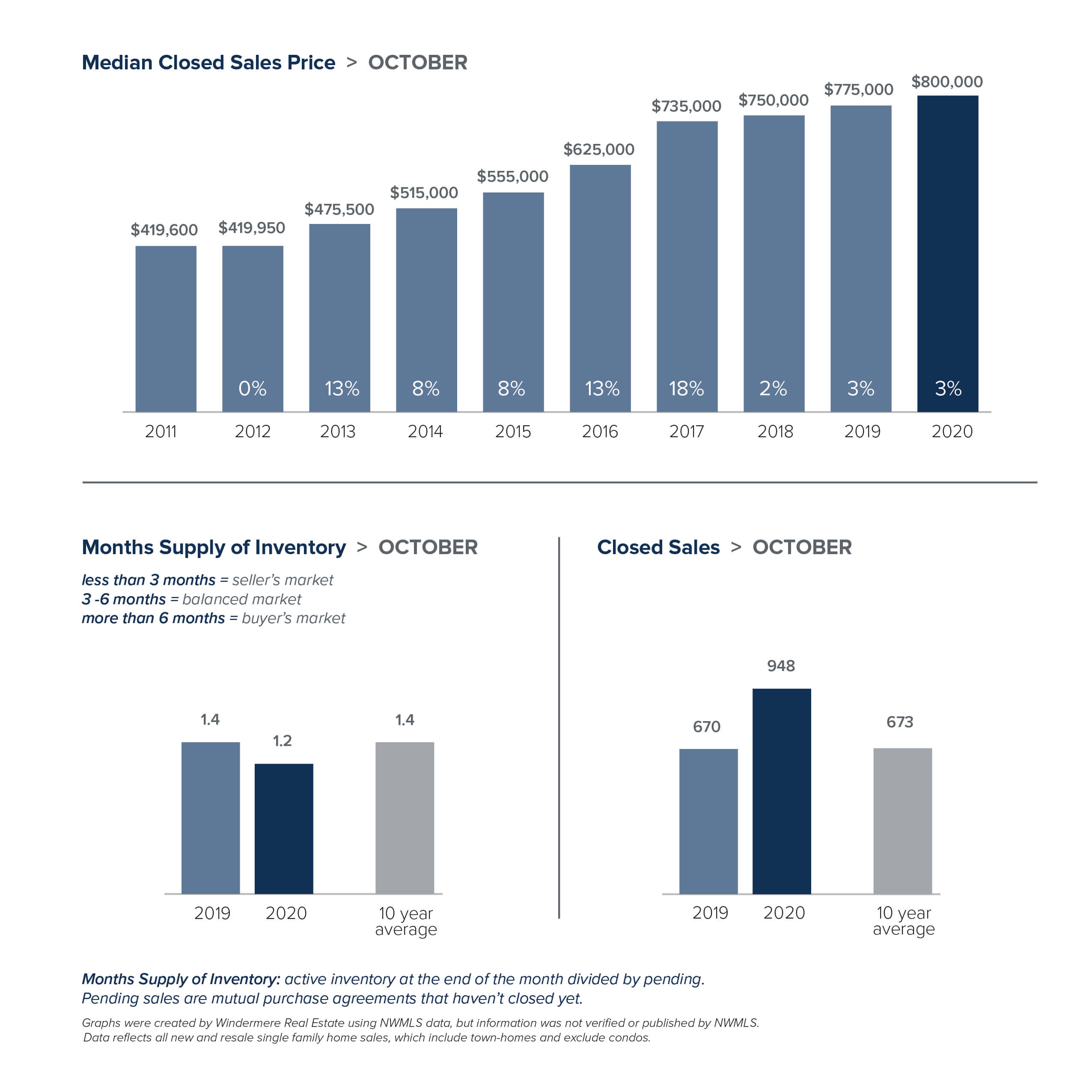

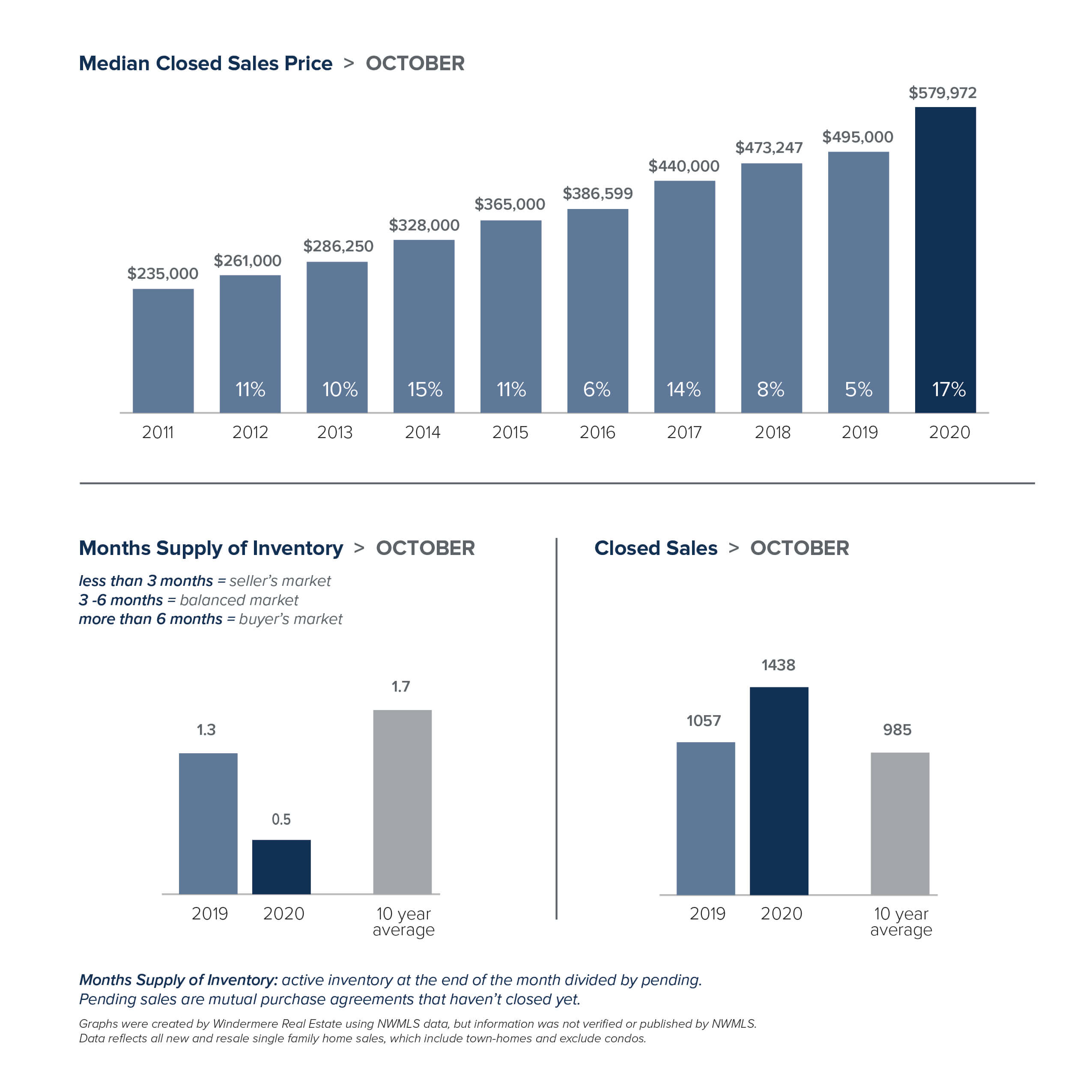

The number of people who can work remotely may be changing the way we view our homes, but one trend has not changed. The local housing market in October remained unseasonably hot. And that doesn’t show signs of changing any time soon.

October saw continued low inventory and record-level sales, with the number of sales exceeding that of 2019 year-to-date.

While new listings are on the rise, they are being snapped up quickly and many homes are selling in a matter of days. In King County there were 38% fewer single-family homes on the market as compared to a year ago. Snohomish County had 59% fewer listings. A four-month supply of homes for sale is considered a balanced market, but King and Snohomish counties currently have less than one month of supply.

With supply unable to keep up with demand, home prices are escalating at double-digit rates. The median single-family home price in King County rose 14% over a year ago to $745,000. Prices in Snohomish County jumped 17% year-over-year to a record high of $579,972. About half the homes that closed in October sold for over the asking price as compared to about a quarter of the homes the same time last year.

The real estate market here is uncommonly resilient. Growing employment in major tech industries and an enviable quality of life have made our region one of the fastest growing areas in the country. With interest rates remaining at record lows, we may well skip the traditional slowing in the winter market altogether.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

The Gardner Report – Q3 2020

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

REGIONAL ECONOMIC OVERVIEW

Employment numbers in Western Washington continue to improve following the massive decline caused by COVID-19. For perspective, the area shed more than 373,000 jobs between February and April. However, the recovery has been fairly robust: almost 210,000 of those jobs have returned. Unemployment levels remain elevated; the current rate is 8.2%. That said, it is down from 16.6% in April. The rate, of course, varies across Western Washington counties, with a current low of 7.2% in King County and a high of 11.2% in Grays Harbor County. The economy is healing, but the pace of improvement has slowed somewhat, which is to be expected. That said, I anticipate that jobs will continue to return as long as we do not see another spike in new infections.

HOME SALES

- Sales continued to improve following the COVID-19-related drop in the first quarter of the year. There were 25,477 transactions in the quarter, an increase of 11.6% from the same period in 2019, and 45.9% higher than in the second quarter of this year.

- Listing activity remains woefully inadequate, with total available inventory 41.7% lower than a year ago, but 1.6% higher than in the second quarter of this year.

- Sales rose in all but two counties, though the declines were minimal. The greatest increase in sales was in San Juan County, which leads one to wonder if buyers are actively looking in more isolated markets given ongoing COVID-19-related concerns.

- Pending sales—a good gauge of future closings—rose 29% compared to the second quarter of the year, suggesting that fourth quarter closings will be positive.

HOME PRICES

- Home-price growth in Western Washington rose a remarkable 17.1% compared to a year ago. The average sale price was $611,793.

- When compared to the same period a year ago, price growth was strongest in Mason, Island, and San Juan counties. Only one county saw prices rise by less than ten percent.

- It was even more impressive to see the region’s home prices up by a very significant 9.4% compared to the second quarter of 2020. It is clear that low mortgage rates, combined with limited inventory, are pushing prices up.

- As long as mortgage rates stay low, and there isn’t an excessive spike in supply (which is highly unlikely), prices will continue to rise at above-average rates. That said, if this continues for too long, we will start to face affordability issues in many markets.

DAYS ON MARKET

- The average number of days it took to sell a home in the third quarter of this year dropped two days compared to a year ago.

- Snohomish County was the tightest market in Western Washington, with homes taking an average of only 16 days to sell. All but two counties—Lewis and San Juan—saw the length of time it took to sell a home rise compared to the same period a year ago.

- Across the region, it took an average of 36 days to sell a home in the quarter. It is also worth noting that it took an average of 4 fewer days to sell a home than in the second quarter of this year.

- The takeaway here is that significant increases in demand, in concert with remarkably low levels of inventory, continue to drive market time lower.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

High demand, favorable interest rates, and low supply clearly point to a seller’s market in Western Washington. As such, I am moving the needle even more in favor of sellers.

As I suggested earlier in this report, although the market is remarkably buoyant, I am starting to see affordability issues increase in many areas—not just in the central Puget Sound region—and this is concerning. Perhaps the winter will act to cool the market, but something is telling me we shouldn’t count on it.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog

Local Market Update – October 2020

While daily life may seem unpredictable, the local real estate market remains extremely stable. Activity in September acted more like the traditional peak spring market with home sales soaring and prices hitting record highs. Inventory remains very tight and new listings are selling quickly in every price range.

There just aren’t enough homes on the market to meet demand. King County had about half the inventory of a year ago. Snohomish County had 63% fewer available homes. On the other hand, the number of condos on the market in King County jumped by 24% over last September. Brokers attribute the flood of new inventory to COVID remote workers looking to trade their in-city condo for more living space. Despite the increase in inventory, condo prices rose 8% in September and pending sales — the best indicator of current demand — shot up 36% over the same period last year.

The slim supply of single-family homes means bidding wars and all-cash offers were the norm, driving prices to record highs. King County saw the third consecutive month of record-setting values. The median home price hit $753,600 in September, a 14% jump over last year. Prices in Snohomish County soared 16% from a year ago to $569,997, just shy of its all-time high of $575,000. For both counties, half the homes sold for over list price in September as compared with just a quarter of the homes a year ago.

The market doesn’t show signs of cooling off any time soon. In September the greater Northwest area saw the highest number of transactions since June 2018. Pending sales were up 32% in King County and 29% in Snohomish County. Interest rates continue to be at historic lows. With the area posting some of the fastest population growth in the country, expect the market to stay unseasonably hot.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GettheWReport.com

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link