The Gardner Report – Q1 2021

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me!

REGIONAL ECONOMIC OVERVIEW

In the summer and fall of 2020, Western Washington regained some of the jobs lost due to COVID-19, but employment levels in the region have been in a holding pattern ever since. As of February, the region had recovered 132,000 of the 297,000 jobs that were lost, but that still leaves the area down by 165,000 positions. Given the announcement that several counties may have to roll back to phase 2 of reopening, I would not be surprised to see businesses hold off on plans to add to their payrolls until the picture becomes clearer. Even with this “pause” in the job recovery, the region’s unemployment rate ticked down to 6.1% from the December rate of 6.4% (re-benchmarking in 2020 showed the December rate was higher than the originally reported 5.5%). The lowest rate was in King County (5.3%) and the highest rate was in Grays Harbor County, which registered at 9.2%. Despite the adjustment to the 2020 numbers, my forecast still calls for employment levels to increase as we move through the year, though the recovery will be slower in areas where COVID-19 infection rates remain elevated.

WESTERN WASHINGTON HOME SALES

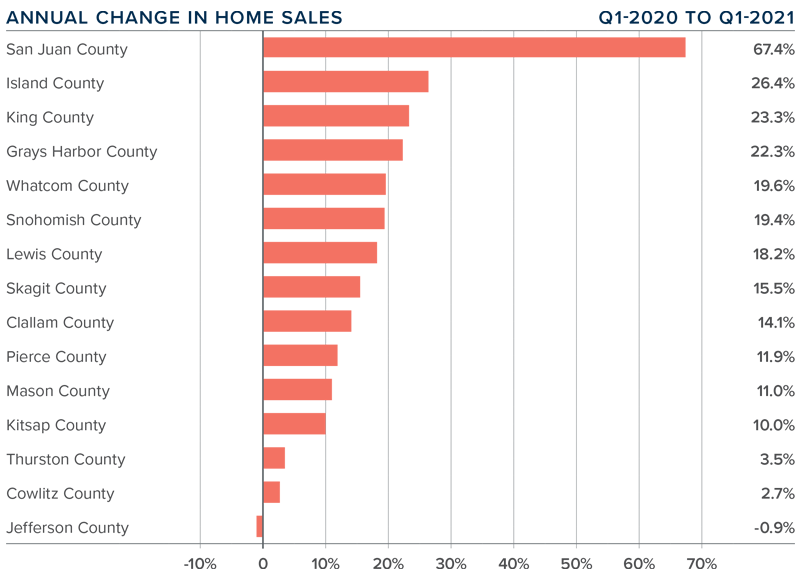

❱ Sales in the first quarter were impressive, with 15,893 home sales. This is an increase of 17.5% from the same period in 2020, but 32% lower than in the final quarter of last year—a function of low levels of inventory.

❱ Listing activity continues to be well below normal levels, with total available inventory 40.7% lower than a year ago, and 35.5% lower than in the fourth quarter of 2020.

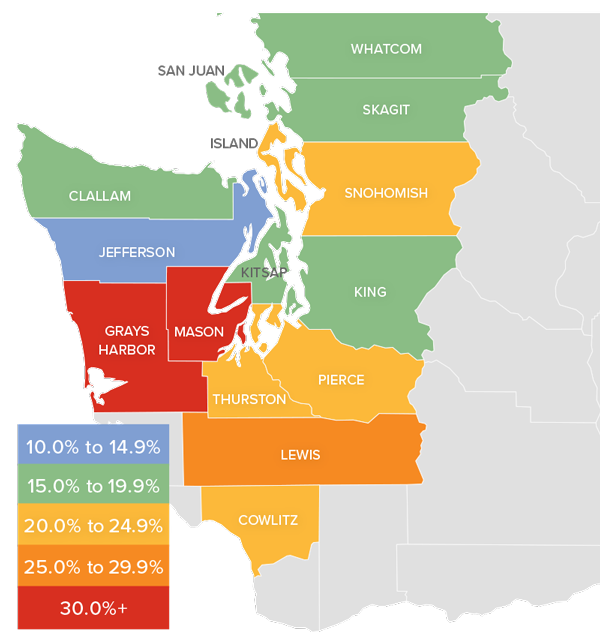

❱ Sales rose in all counties other than Jefferson, though the drop there was only one unit. There were significant increases in almost every other county, but sales growth was more muted in Cowlitz and Thurston counties. San Juan County again led the way, likely due to ongoing interest from second-home buyers.

❱ The ratio of pending sales (demand) to active listings (supply) shows how competitive the market is. Western Washington is showing pendings outpacing new listings by a factor of almost six to one. The housing market is as tight now as I have ever seen it.

WESTERN WASHINGTON HOME PRICES

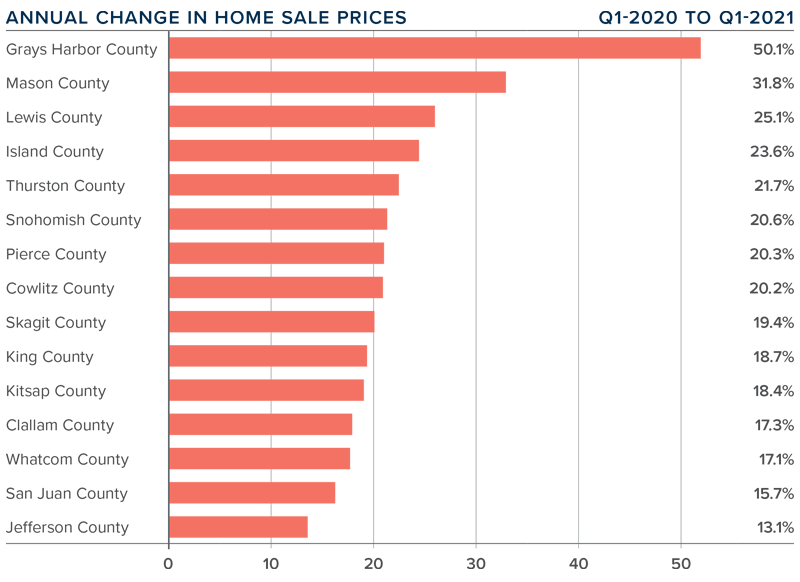

❱ Home price growth in Western Washington continues to trend well above the long-term average, with prices 21.3% higher than a year ago. The average home sale price was $635,079.

❱ Compared to the same period a year ago, price growth was strongest in Grays Harbor and Mason counties, but all markets saw double-digit price growth compared to a year ago.

❱ Home prices were also 2.9% higher than in the final quarter of 2020, which was good to see given that 30-year mortgage rates rose .4% in the quarter.

❱ I expect to see mortgage rates continue to trend higher as we move through the year, but they will remain significantly lower than the long-term average. Any increase in rates can act as a headwind to home-price growth, but excessive demand will likely cause prices to continue to rise.

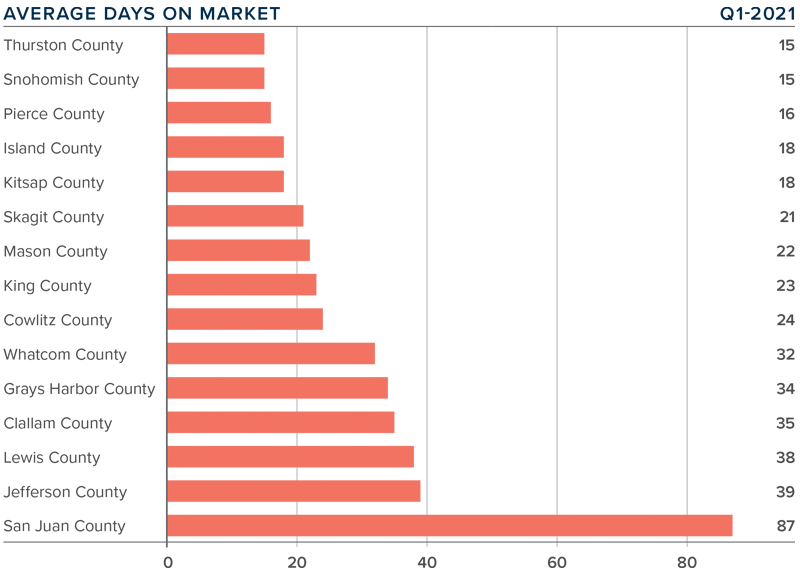

DAYS ON MARKET

❱ The market in early 2021 continued to show far more demand than supply, which pushed the average time it took to sell a home down 25 days compared to a year ago. It took 2 fewer days to sell a home than it did in the final quarter of 2020.

❱ Snohomish and Thurston counties were the tightest markets in Western Washington, with homes taking an average of only 15 days to sell. The greatest drop in market time was in San Juan County, where it took 52 fewer days to sell a home than it did a year ago.

❱ Across the region, it took an average of only 29 days to sell a home in the quarter. All counties saw market time decrease from the first quarter of 2020.

❱ Very significant demand, in concert with woefully low levels of supply, continues to make the region’s housing market very competitive. This will continue to be a frustration for buyers.

CONCLUSIONS

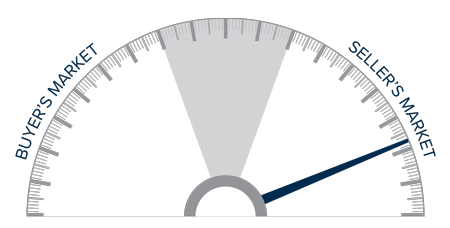

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Demand is very strong and, even in the face of rising mortgage rates, buyers are still out in force. With supply still lagging significantly, it staunchly remains a seller’s market. As such, I am moving the needle even further in their favor.

As I mentioned in last quarter’s Gardner Report, 2021 will likely see more homeowners make the choice to sell and move if they’re allowed to continue working remotely. On the one hand, this is good for buyers because it means more listings to choose from. However, if those sellers move away from the more expensive core markets into areas where housing is cheaper, it could lead to increased competition and affordability issues for the local buyers in those markets.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com blog

Buying with Gardening in Mind

Every home buyer has a list of must-have amenities that they’re just not willing to compromise on. For some, it could be an open floor plan or maybe a certain number of bedrooms. For others, that priority is a place to garden.

A garden provides a place where one can nurture the earth, feel connected to other living things, and have a positive impact on the environment. If you’re a home buyer who requires space to garden, here are a few things to consider:

The Hardiness Zone

When searching for a home, location is always high on the list of priorities, and for gardeners, it’s no different. If having a garden is important to you, the first thing you should do is check the hardiness zone to determine what you can realistically grow at any home you are considering buying.

Hardiness Zones are used by gardeners and growers around the United States to determine which plants will grow best in their region. The USDA uses the average annual minimum water temperature in the area to establish the zones, making it a great place to start when looking for your next garden.

Hardiness Zones don’t change by street like neighborhoods do but knowing where you are in the zones map can be a helpful guide to what to expect, especially if you’re moving to a completely new region.

Outdoor Space

Your Windermere agent will be able to use a combination of property metrics, photos, and land surveys to help narrow down your search to homes with adequate outdoor space for a garden.

Ask your agent about lot size versus the home size to make sure there is enough land to build and sustain a garden. Prior to visiting homes in person, check the exterior photos to get an idea of the area.

Local Wildlife

Local wildlife organizations have resources about the animals that might appear in your backyard. Knowing this will not only help you protect your veggies, herbs, and other plantings, but also aid in creating a wildlife-friendly sanctuary. The National Wildlife Foundation offers suggestions on how to do this and offers tips on how to attract songbirds and butterflies to your garden.

Infrastructure Requirements

Depending on the size of your garden, you may need to set up appropriate infrastructure for easier care, like a sprinkler system, raised beds, or outbuildings. If the land is uneven, consider installing raised beds that will help flatten the growing surface for your veggies and fickle flowers. A greenhouse can help you control humidity and light levels but be sure to consider the construction costs alongside your home loan amount.

This post originally appeared on the Windermere.com Blog

Local Market Update – April 2021

Despite a bump in new listings the supply of homes still can’t keep up with the demand. The result? Multiple offers, escalation clauses, and record-breaking prices. If you’re considering selling your home, you’d be hard pressed to find a more lucrative market than what we have today.

March marked the first post-COVID/pre-COVID comparison, and the results were dramatic.

The drop in the number of listings was profound. In King County there were 54% fewer single-family homes on the market at the end of March than the same time a year ago. The Eastside had 68% fewer listings. There were just 216 homes for sale on the Eastside, which stretches from Issaquah to Woodinville. Extensive new investments there, including Amazon’s plan to add 25,000 jobs in Bellevue, will only increase demand for housing. North King County, which includes Richmond Beach and Lake Forest Park had just 26 homes for sale. In Seattle, the 498 listings there represents a drop of 18% from a year ago. Despite the comparatively greater number of listings, Seattle still has only two weeks of available inventory. The situation was even more dire in Snohomish County. With the number of homes for sale down 68%, the county has just one week of inventory.

So why is inventory so low? The pandemic certainly has played a part. People now working from home have bought up properties with more space in more desirable locations. Nervousness and uncertainty about COVID compelled many would-be sellers to postpone putting their home on the market. Downsizers who may have moved into assisted living or nursing homes are staying in place instead. But there are other factors as well.

For more than a decade, less new construction has been built relative to historical averages, particularly in the suburbs. Interest rates have also been a factor. Windermere Chief Economist Matthew Gardner noted, “I think a lot of the urgency from buyers is due to rising mortgage rates and the fear that rates are very unlikely to drop again as we move through the year, which is a safe assumption to make.” Homeowners who refinanced when rates were at record lows are staying in their homes longer, keeping more inventory off the market. And those same low interest rates have compelled many homeowners who bought a new home not to sell their previous one, but to keep it as a rental property.

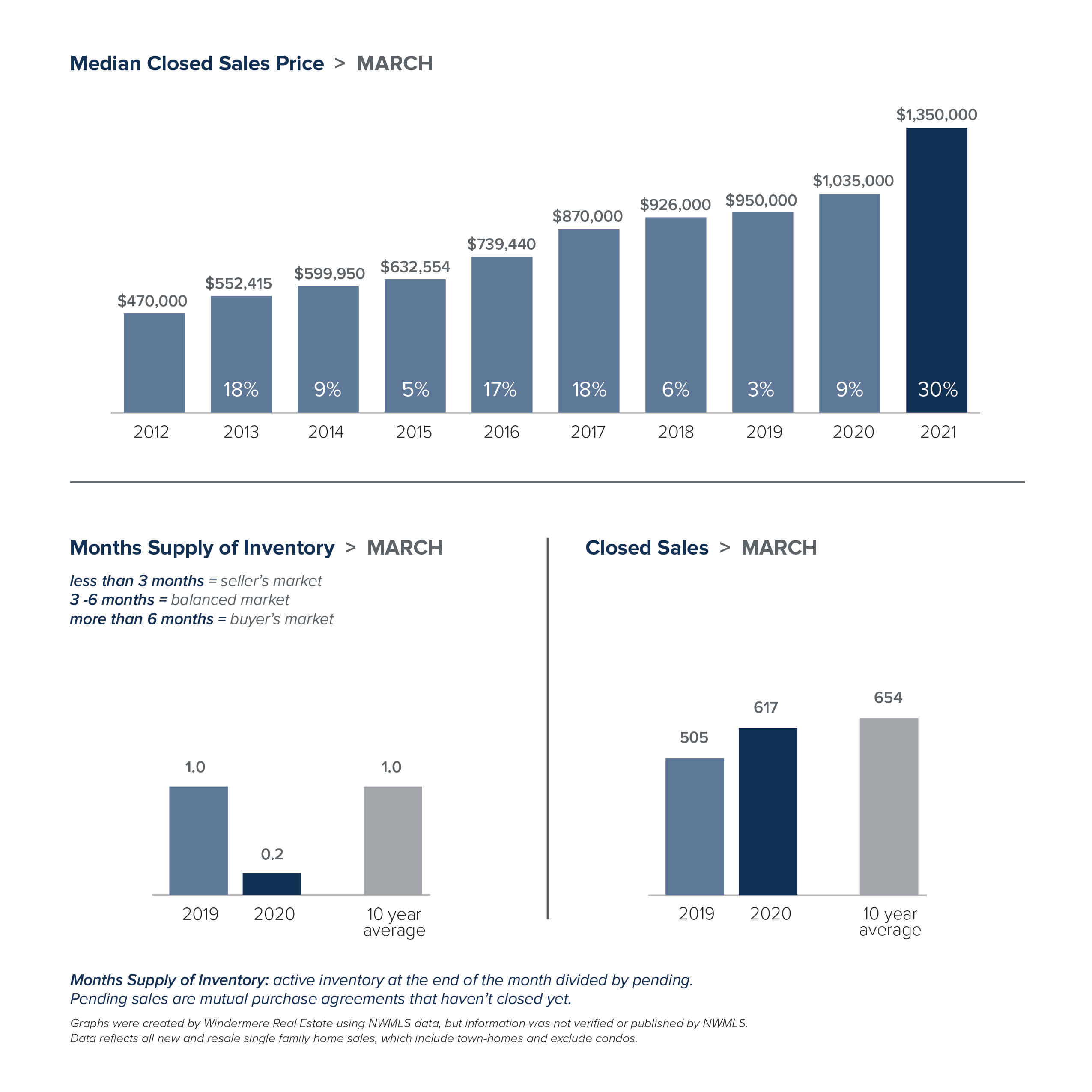

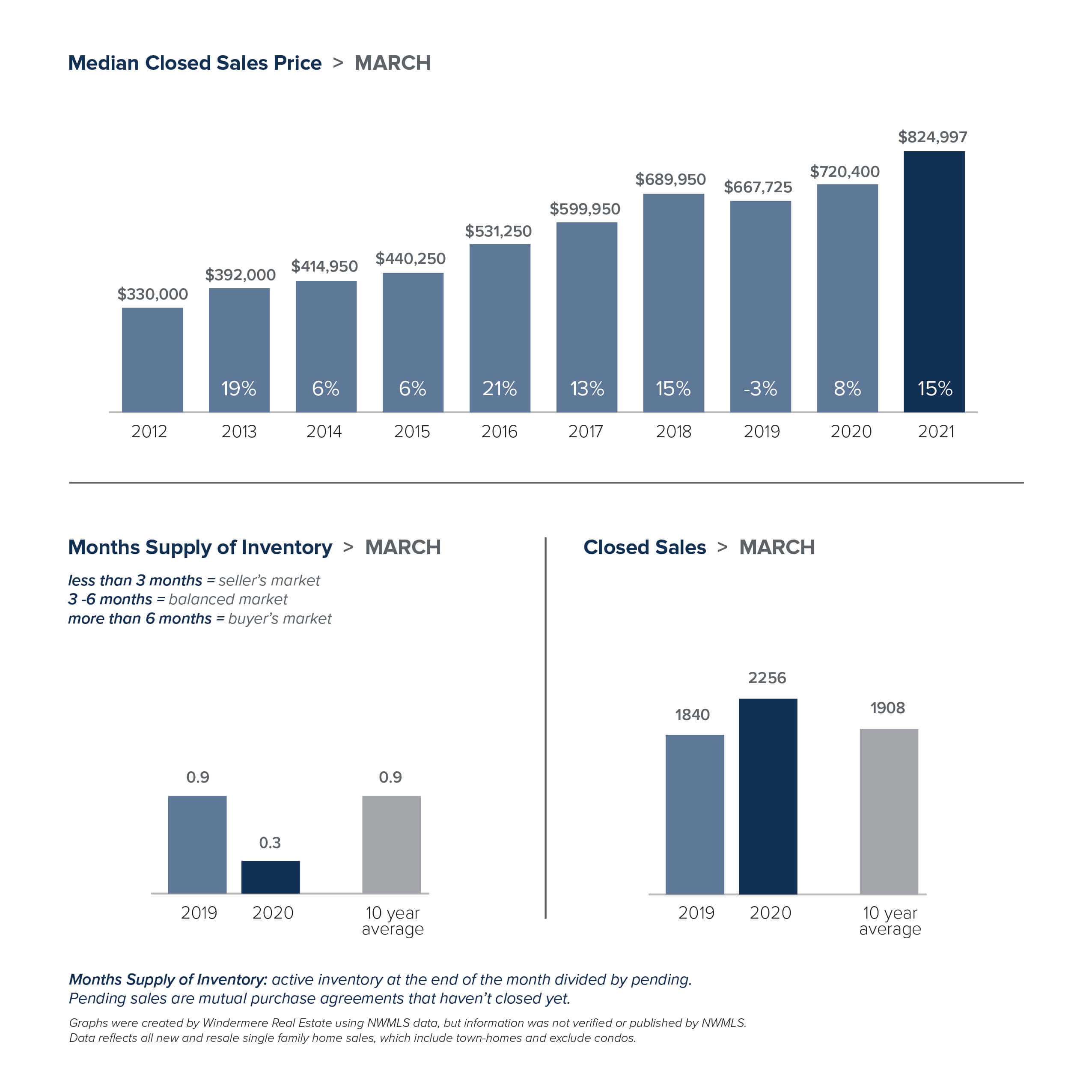

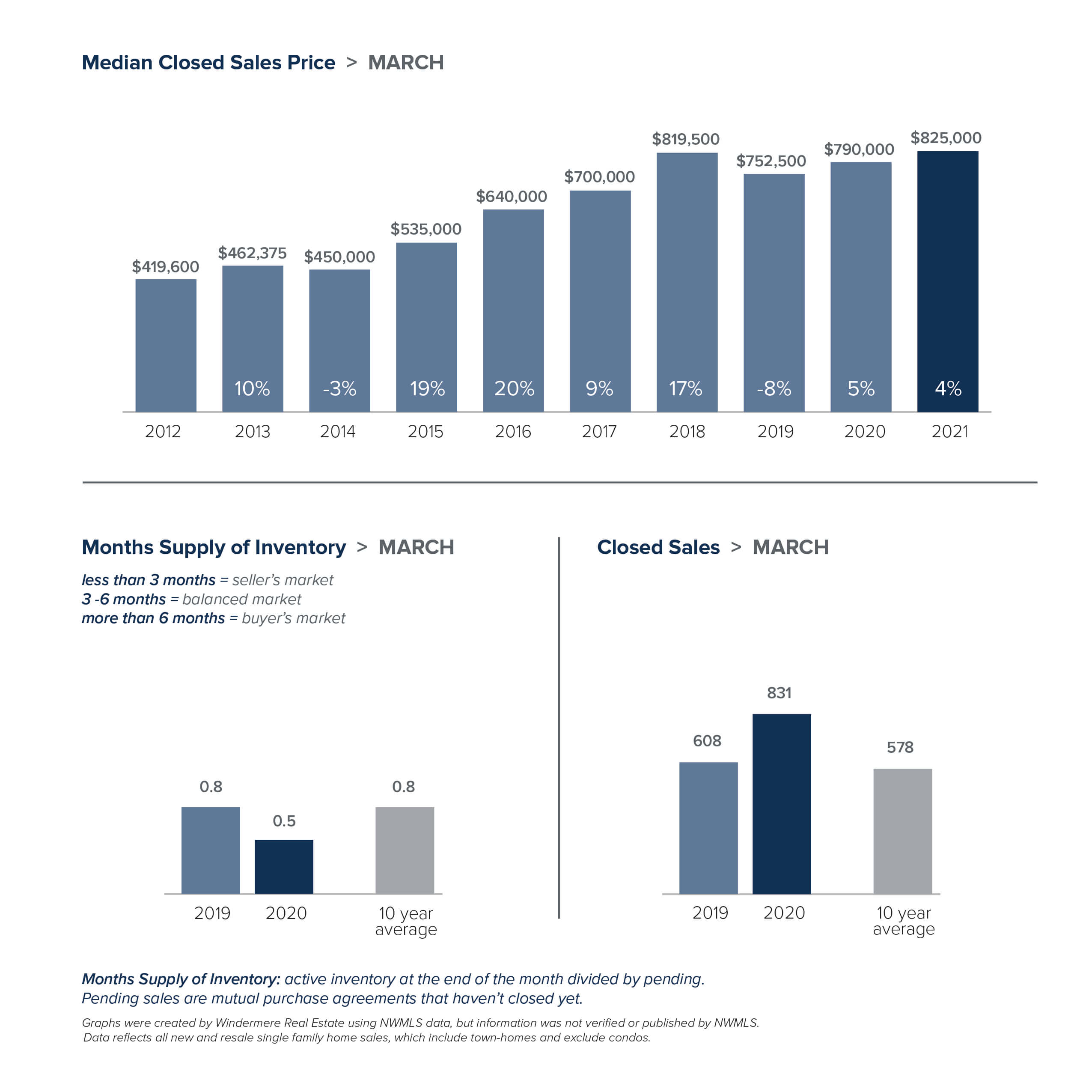

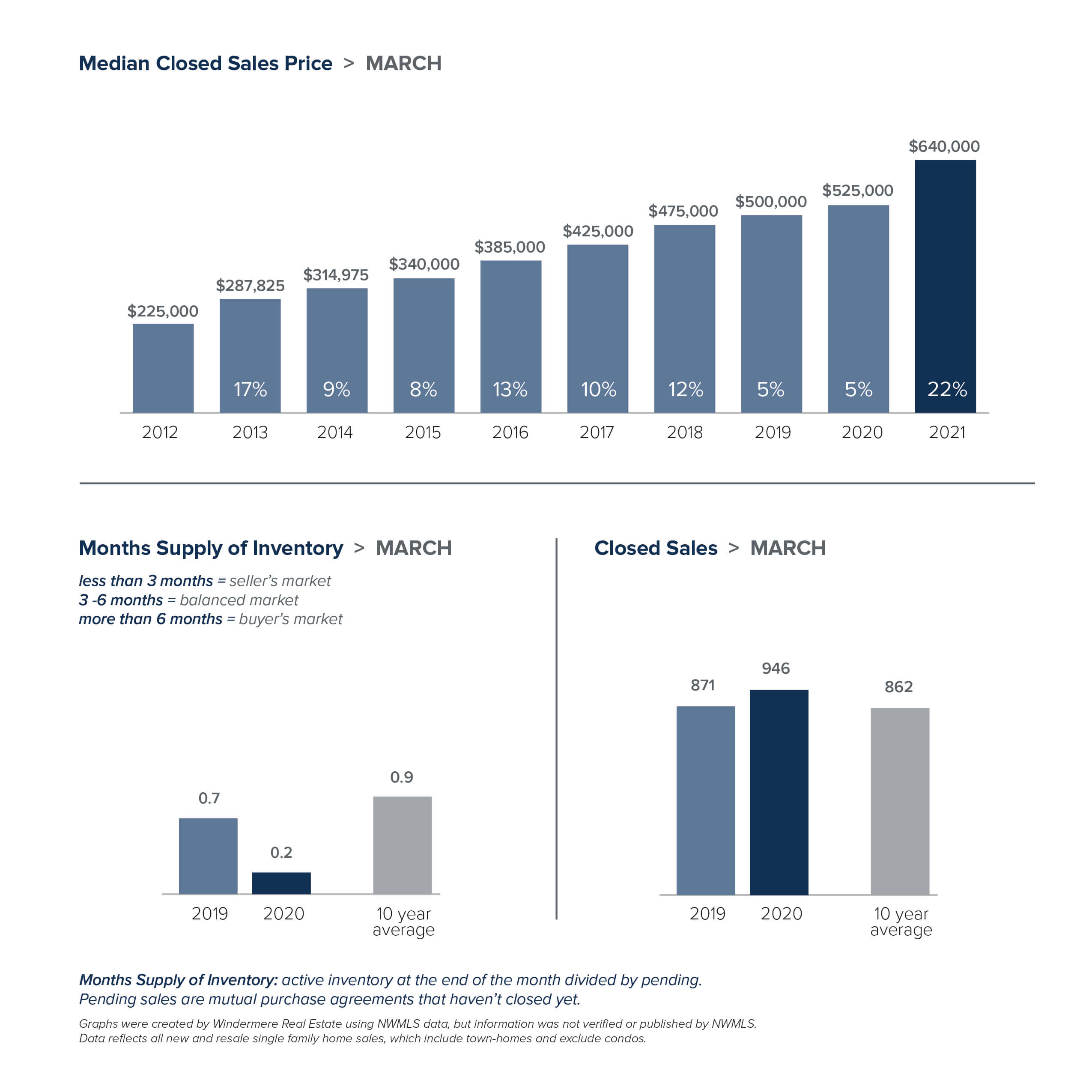

While the number of listings tanked, the number of sales skyrocketed. That’s the recipe for soaring home prices. Housing prices here have been growing at the second-fastest rate in the nation for a full year. Nearly every area of King County saw double-digit price increases, with the exception of Seattle. In King County the median price for a single-family home in March was a record-high $825,000, up 15% from a year ago and an increase of 10% from February. The median home price topped $1 million for every city on the Eastside, where the overall median price surged 30% to $1,350,000, the highest median price ever recorded for the area. Seattle homes prices were also record-breaking, rising 4% to $825,000. Snohomish County prices set yet another all-time high as the median home price jumped 22% to $640,000.

The appeal of our area just keeps growing. For the second time, Washington took the No. 1 spot in the U.S. News Best States ranking – the first state to earn the top ranking twice in a row. The bottom line: the local real estate market is extremely competitive, and it shows no signs of slowing down. Successfully navigating today’s market takes a strong plan. Your broker can work with you to determine the best strategies for your individual situation.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GettheWReport.com

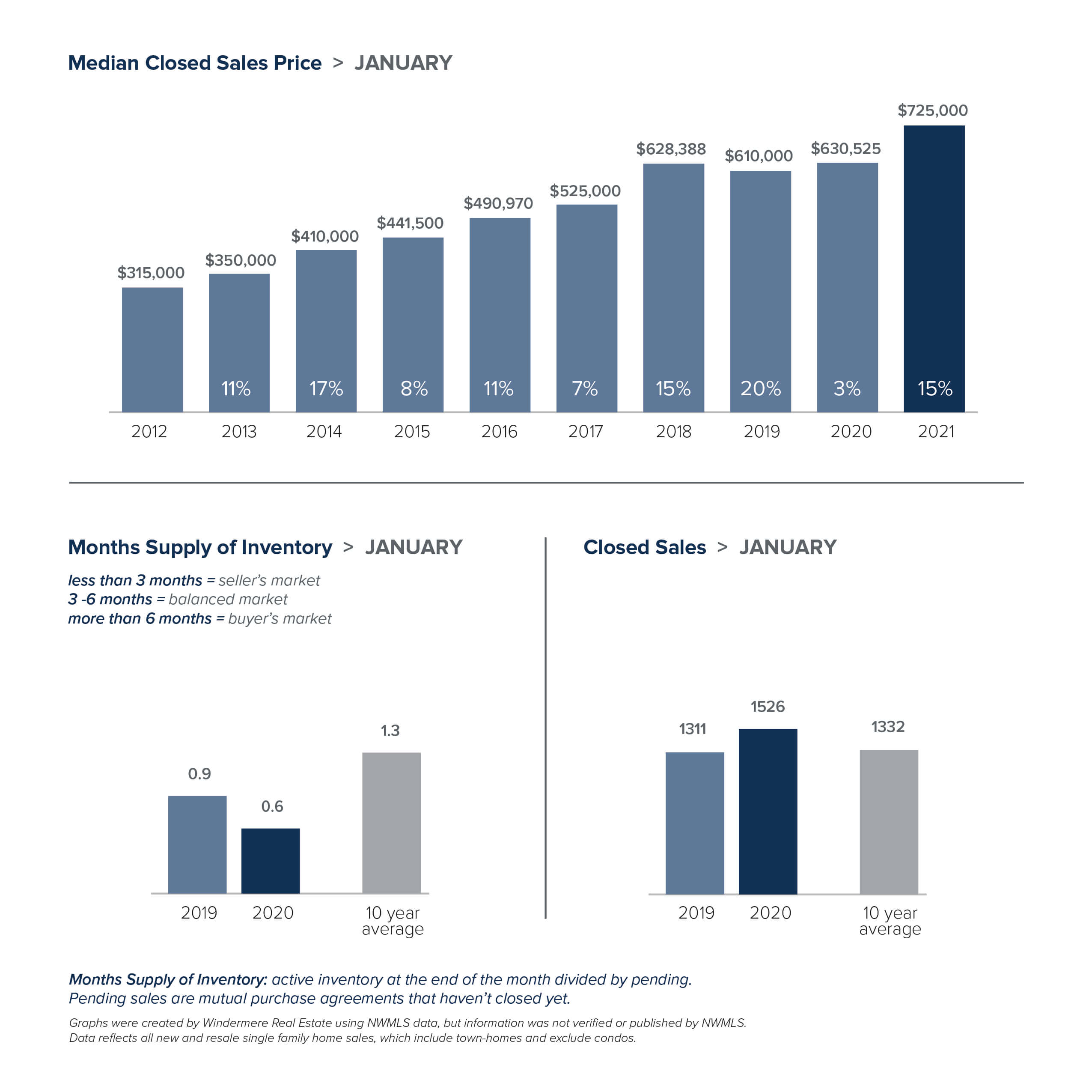

Local Market Update – February 2021

This winter’s real estate market is looking more like a typical spring market. Sales were up, competition was fierce and prices continued to rise.

Lack of inventory still presents a huge issue. At the end of January there were only 1,055 single-family homes on the market in all of King County, 33% fewer than a year ago. If that wasn’t tight enough, Snohomish County had only 298 single-family homes for sale, 63% fewer than a year ago. Condos remain a bright spot for buyers frustrated by the frenzied market. January saw a nearly 50% increase in the number of condos for sale in King County. However, the increase in inventory didn’t translate into a drop in price. The median condo price was flat for the county, up 10% in Seattle and up 7% on the Eastside. Those looking for a relative bargain should consider Southwest and Southeast King County where the median condo prices were $254,275 and $269,900 respectively.

The large imbalance between supply and demand sent prices higher. Home prices here are climbing at the second-fastest rate in the nation. The median price of a single-family home in King County was $725,000, a 15% jump from a year ago. Seattle home prices increased 10% to $791,471. Inventory on the Eastside was down 58%, sending the median home price soaring 29% to $1.15 million. Snohomish County saw prices rise 18% to $599,990, well surpassing its previous high of $575,000.

While low interest rates take some of the sting out of rising prices, multiple offers over asking price have become the norm and are expected to continue. The easing of COVID restrictions may add yet more competition. Both King and Snohomish counties have moved into Phase 2 of the Healthy Washington plan, which allows open houses to resume with up to 10 people socially distanced.

All signs point to this strong seller’s market continuing for some time. The person who represents you as a buyer can make the difference in owning a home or not. Brokers are advising buyers to create a plan that prioritizes their wish list and sets realistic expectations in this hyper-competitive market.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Q4 2020 Western Washington Real Estate Market Update

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact me!

REGIONAL ECONOMIC OVERVIEW

After the COVID-19-induced declines, employment levels in Western Washington continue to rebuild. Interestingly, the state re-benchmarked employment numbers, which showed that the region lost fewer jobs than originally reported. That said, regional employment is still 133,000 jobs lower than during the 2020 peak in February. The return of jobs will continue, but much depends on new COVID-19 infection rates and when the Governor can reopen sections of the economy that are still shut down. Unemployment levels also continue to improve. At the end of the quarter, the unemployment rate was a very respectable 5.5%, down from the peak rate of 16.6% in April. The rate varies across Western Washington, with a low of 4.3% in King County and a high of 9.6% in Grays Harbor County. My current forecast calls for employment levels to continue to improve as we move through the spring. More robust growth won’t happen until a vaccine becomes widely distributed, which is unlikely to happen before the summer.

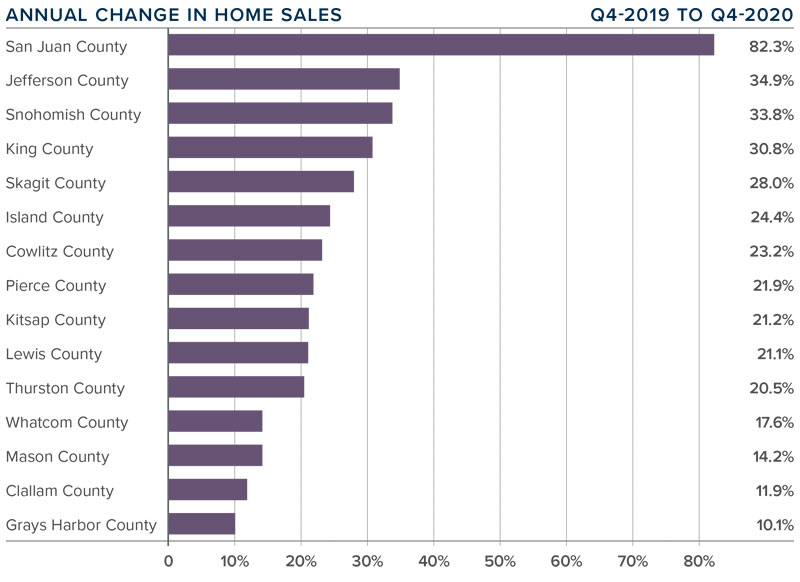

WESTERN WASHINGTON HOME SALES

❱ Sales continued to impress, with 23,357 transactions in the quarter. This was an increase of 26.6% from the same period in 2019, but 8.3% lower than in the third quarter of last year, likely due to seasonality.

❱ Listing activity remained very low, even given seasonality. Total available inventory was 37.3% lower than a year ago and 31.2% lower than in the third quarter of 2020.

❱ Sales rose in all counties, with San Juan County seeing the greatest increase. This makes me wonder if buyers are actively looking in more remote markets given ongoing COVID-19 related concerns.

❱ Pending sales—a good gauge of future closings—were 25% higher than a year ago but down 31% compared to the third quarter of 2020. This is unsurprising, given limited inventory and seasonal factors.

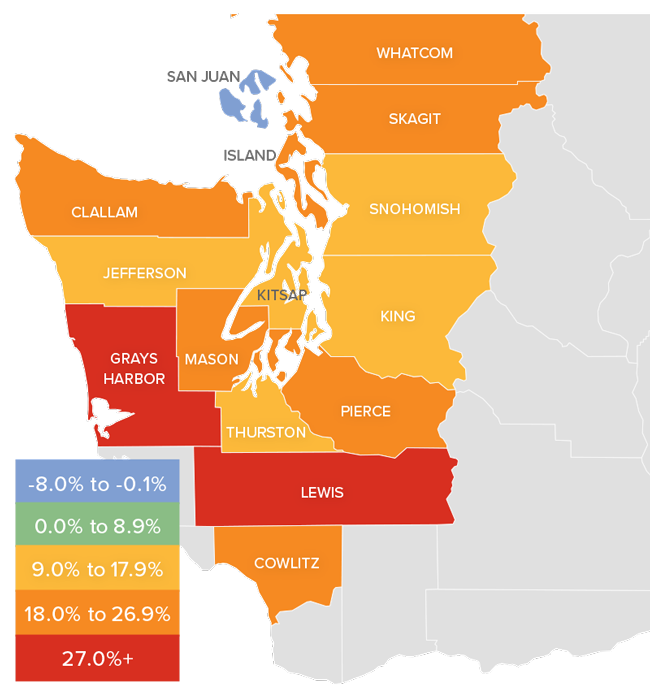

WESTERN WASHINGTON HOME PRICES

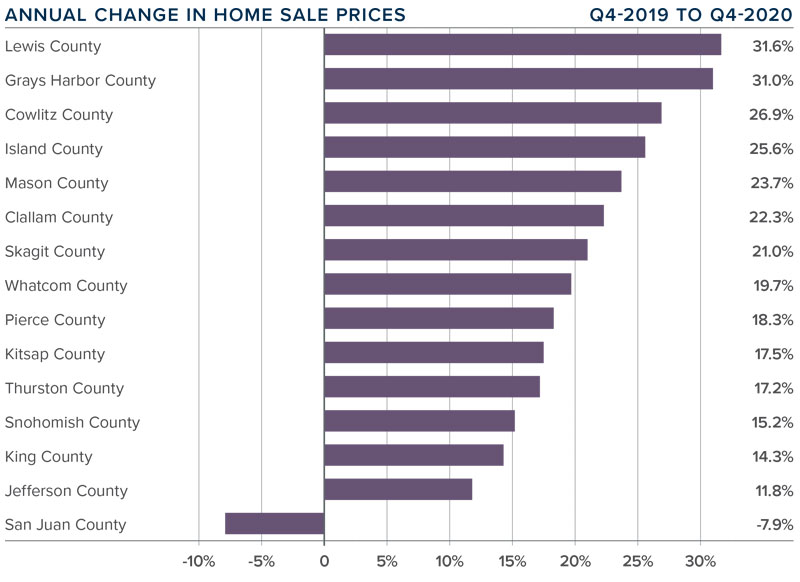

❱ Home price growth in Western Washington continued the trend of above-average appreciation. Prices were up 17.4% compared to a year ago, with an average sale price of $617,475.

❱ Year-over year price growth was strongest in Lewis and Grays Harbor counties. Home prices declined in San Juan County which is notoriously volatile because of its small size.

❱ It is interesting to note that home prices were only 1% higher than third quarter of 2020. Even as mortgage rates continued to drop during the quarter, price growth slowed, and we may well be hitting an affordability ceiling in some markets.

❱ Mortgage rates will stay competitive as we move through 2021, but I expect to see price growth moderate as we run into affordability issues, especially in the more expensive counties.

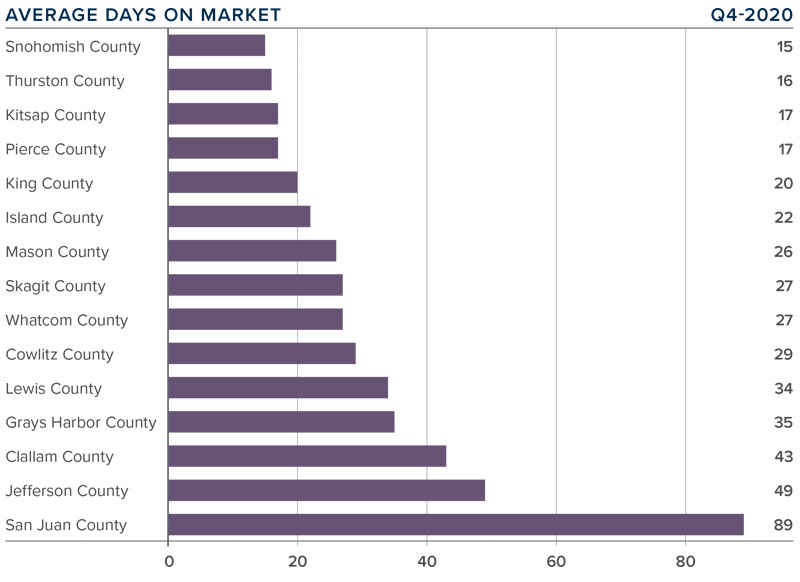

DAYS ON MARKET

❱ 2020 ended with a flourish as the average number of days it took to sell a home in the final quarter dropped by a very significant 16 days compared to a year ago.

❱ Snohomish County was again the tightest market in Western Washington, with homes taking an average of only 15 days to sell. The only county that saw the length of time it took to sell a home rise compared to the same period a year ago was small Jefferson County, but it was only an increase of four days.

❱ Across the region, it took an average of 31 days to sell a home in the quarter. It is also worth noting that, even as we entered the winter months, it took an average of five fewer days to sell a home than in the third quarter of last year.

❱ The takeaway here is that demand clearly remains strong, and competition for the few homes available to buy continues to push days on market lower.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Demand has clearly not been impacted by COVID-19, mortgage rates are still very favorable, and limited supply is causing the region’s housing market to remain incredibly active. Because of these conditions, I am moving the needle even further in favor of sellers.

2021 is likely to lead more homeowners to choose to move if they can work from home, which will continue to drive sales growth and should also lead to more inventory. That said, affordability concerns in markets close to Western Washington’s job centers, in combination with modestly rising mortgage rates, should slow the rapid home price appreciation we have seen for several years. I, for one, think that is a good thing.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog

Local Market Update – December 2020

Nothing about 2020 is normal, and that includes real estate trends. The housing market typically slows significantly during the holiday season, but that is not the case this year. Buyer interest is strong, sales are up, and prices have followed suit.

A recent report ranked our area as the most competitive real estate market in the country, with 71% of homes selling within two weeks. While the number of new listings in November were up compared to a year ago, there just wasn’t enough inventory to meet the current surge in demand.

In King County there were 37% fewer single-family homes on the market – 1,621 homes this November vs. 2,592 a year ago. Inventory in Snohomish County is even more strained. At the end of the month there were just 416 homes for sale as compared to 1,204 a year ago, a 65% drop. Both counties had about a two week supply of homes at the end of November. A four month supply of inventory is considered balanced. Buyers in the market for a condominium in King County had much more options. Condo inventory was up 39% over last year.

The inventory-starved market sent home prices higher. The median single-family home price in King County was up 10% over a year ago to $730,500. Home prices in Snohomish County rose 14% to $566,000. In a survey of homebuyers looking for a home during Covid-19, 82% said they would go over budget to get their ideal home. Record-low interest rates have helped soften the blow of soaring prices a bit. According to Freddie Mac, rates on a 30-year fixed-rate mortgage fell to their lowest level, at 2.71%, for the 14th time this year.

With low inventory and high demand, buyers need to be ready to compete. That means being pre-approved or willing to offer cash, and working with an agent on a plan that includes counter-offers, escalation clauses and other strategies to help win the sale. As many consider working remotely long-term, our home has become more important to us than ever.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

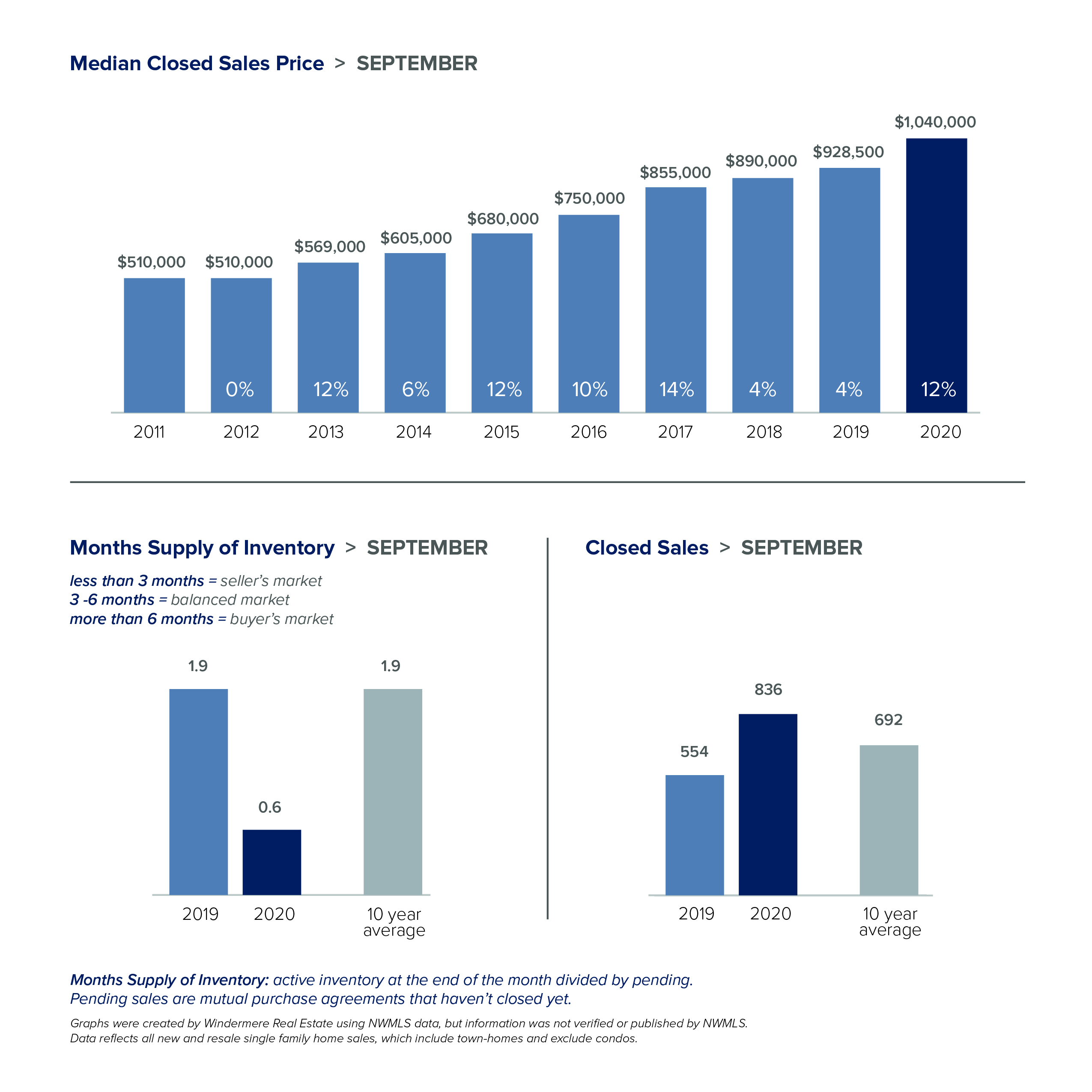

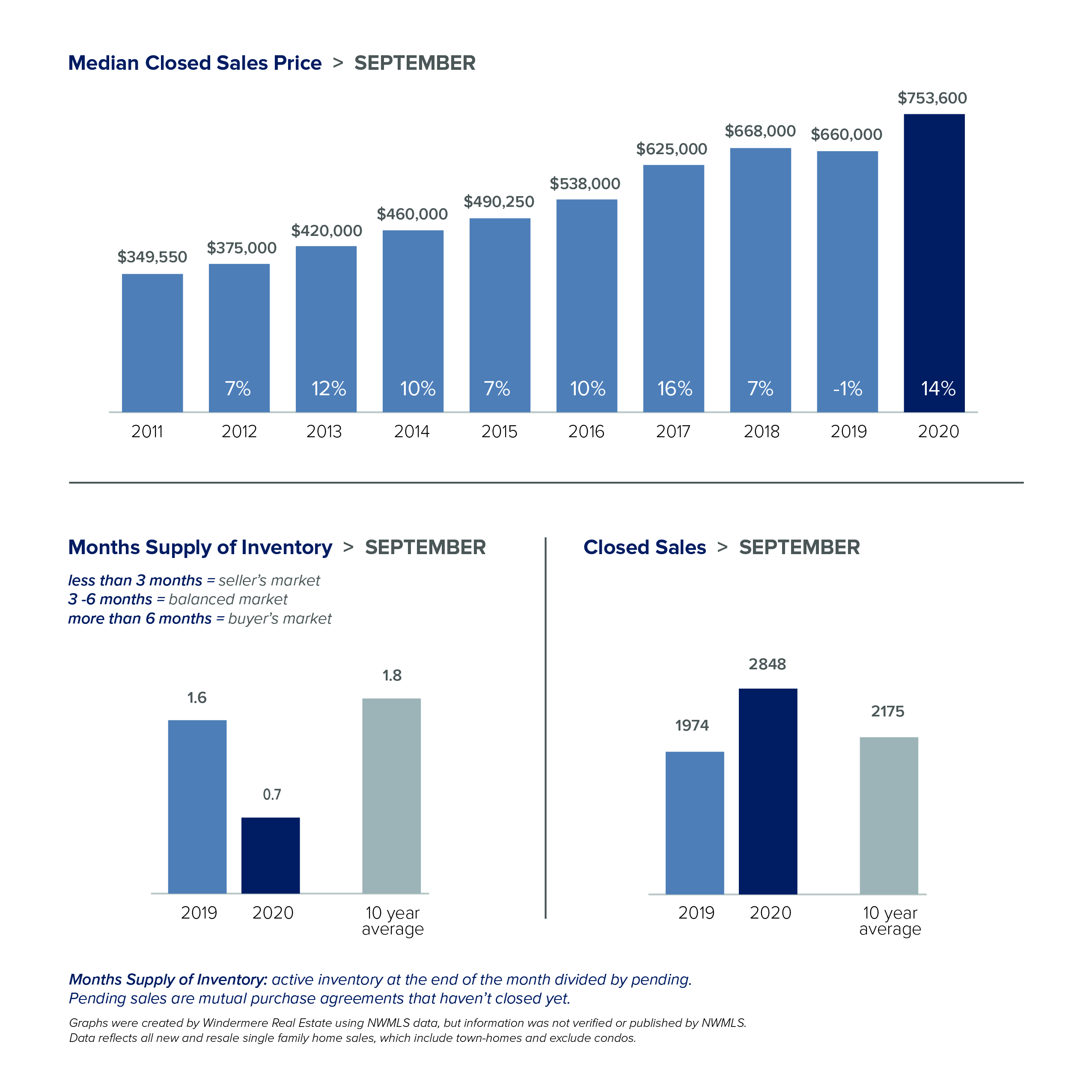

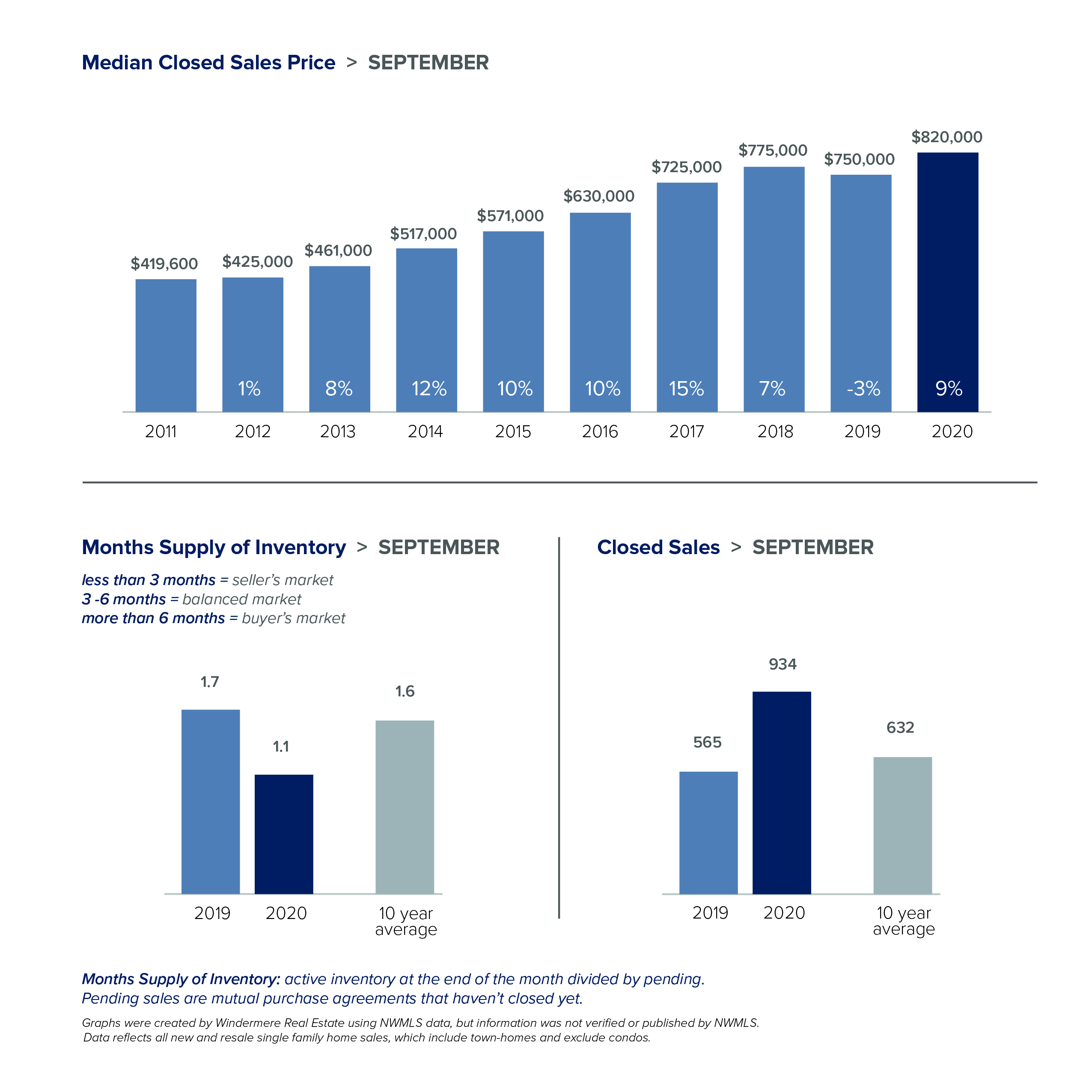

Local Market Update – October 2020

While daily life may seem unpredictable, the local real estate market remains extremely stable. Activity in September acted more like the traditional peak spring market with home sales soaring and prices hitting record highs. Inventory remains very tight and new listings are selling quickly in every price range.

There just aren’t enough homes on the market to meet demand. King County had about half the inventory of a year ago. Snohomish County had 63% fewer available homes. On the other hand, the number of condos on the market in King County jumped by 24% over last September. Brokers attribute the flood of new inventory to COVID remote workers looking to trade their in-city condo for more living space. Despite the increase in inventory, condo prices rose 8% in September and pending sales — the best indicator of current demand — shot up 36% over the same period last year.

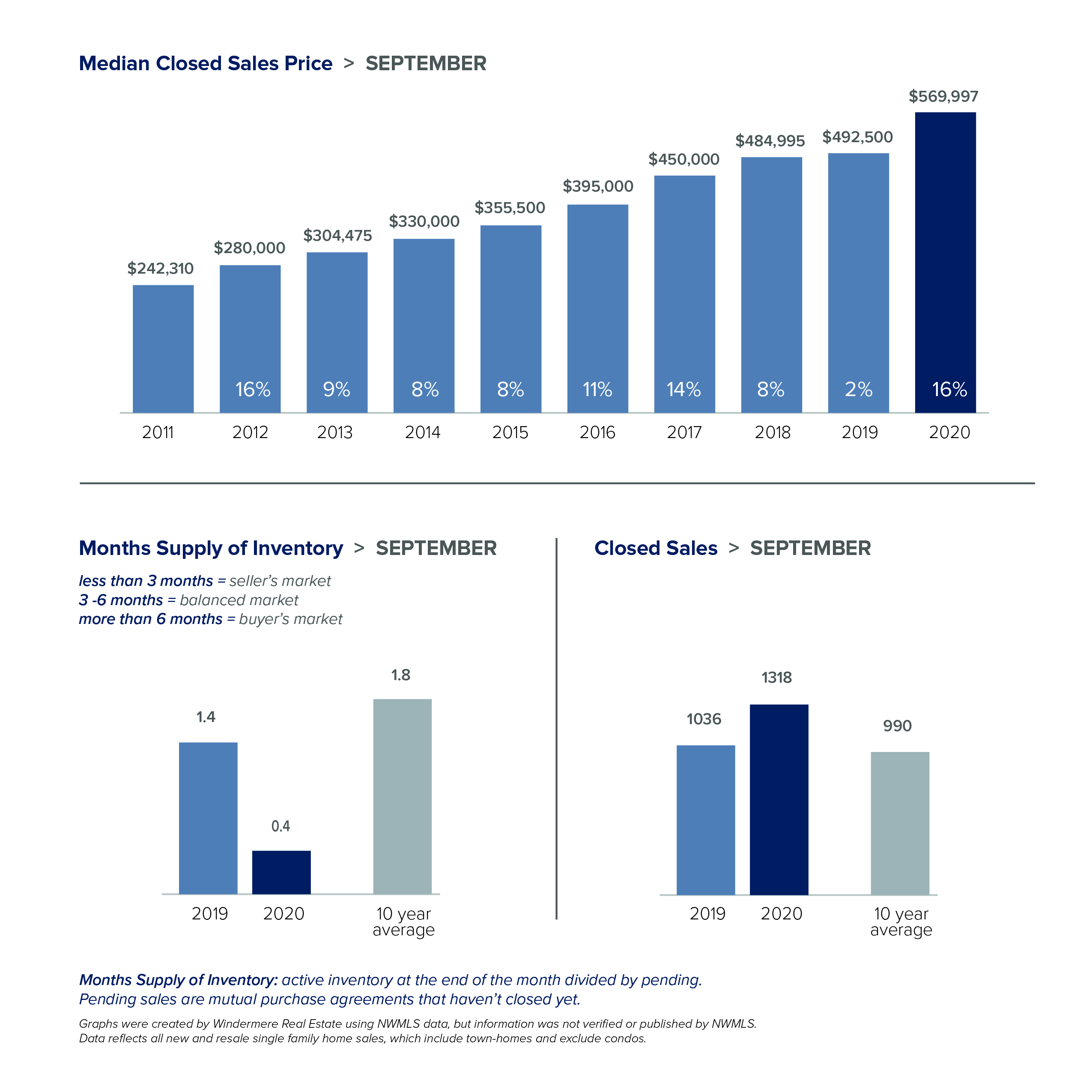

The slim supply of single-family homes means bidding wars and all-cash offers were the norm, driving prices to record highs. King County saw the third consecutive month of record-setting values. The median home price hit $753,600 in September, a 14% jump over last year. Prices in Snohomish County soared 16% from a year ago to $569,997, just shy of its all-time high of $575,000. For both counties, half the homes sold for over list price in September as compared with just a quarter of the homes a year ago.

The market doesn’t show signs of cooling off any time soon. In September the greater Northwest area saw the highest number of transactions since June 2018. Pending sales were up 32% in King County and 29% in Snohomish County. Interest rates continue to be at historic lows. With the area posting some of the fastest population growth in the country, expect the market to stay unseasonably hot.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GettheWReport.com

Windermere Offices Find Safe Ways to Give Back

Pictured foreground to background: Zoe Brady, Kim Hyland, Angela Cherbas. – Eugene, OR

Preparing for the Holiday Season – Coeur d’Alene, Idaho

On August 29, Windermere’s Coeur d’Alene offices donated $500 to Heart Reach, Inc., the non-profit food bank of the local Heart of the City Church, in support of their 2020 Turkeys and More program. With Thanksgiving right around the corner, this donation will help Heart Reach jumpstart their program year. Heart Reach will work with the United Way to identify and assist 1,700 families facing financial hardship in Kootenai County and provide them with food this holiday season.

Pictured L to R: Evalyn Adams, Heart Reach Inc. coordinator for Turkeys and More, agents Rich Dussell, Karen Hansen and Vicky Houle of Windermere Coeur d’Alene Realty. – Coeur d’Alene, ID

Let the Kids Play! – Seattle, WA

On August 5, the Windermere Sand Point office held their own Community Service Day at Thornton Creek Elementary school, readying the playground for use when school is back in session. Broker Tammy Heldridge led talks with the school district to put the event together, taking proper precautions to follow COVID-19 guidelines. Along with additional help from Heather Curiel, Brixton Ward, and Kate Chamberlin from the Windermere Northgate Office, the brokers, staff, and volunteers worked hard weeding, leveling sand, spreading wood chips and moving planters. Representatives from Seattle Public Schools’ Facilities Department lent a helping hand and by the end of the day, the playground was ready for play.

Above: Pictured L to R: Tammy Heldridge and Kian Pornour

Below: R: Renee Menti Ruhl – Thornton Creek Elementary – Seattle, WA

Gardening For Food Access – Lane County, Oregon

Over the course of three Fridays in August, staff and agents from Windermere Real Estate Lane County worked to transform the gardens of local food bank Food For Lane County, whose mission is to “Reduce Hunger by engaging our community to create access to food.” Working in groups of no more than ten and wearing masks, the teams took to the fields, shoveling dirt and hauling wheelbarrows, breathing new life into gardens that provide food for the community. Even though their original Community Service Day was canceled, “we still wanted to find a way to help the community, especially in a time like this when so many families are having a hard time putting food on the table due to Covid-19,” said Administrative Assistant, Whitney Schmidbauer.

Above: Pictured foreground to background: Zoe Brady, Kim Hyland, Angela Cherbas. Below: Angela Cherbas – Eugene, OR

Feeding Ronald McDonald House Families – Seattle, WA

Through the Windermere Foundation, Windermere Wedgwood donated 50 chicken dinners on August 19 to Ronald McDonald House through local restaurant Wedgwood Broiler. The office was originally scheduled to make dinners for the families at the Ronald McDonald House kitchen earlier this spring. But since the pandemic put a strain on visitors and in-house meal prep, they asked for meals to be packaged and brought in for the families to enjoy. Wedgwood Broiler stepped up with meals of roasted chicken, rice pilaf and fresh veggies.

Pictured L to R: Ann O’Neil, Jay Nemitz, and Michele Flinn picked up the meals and delivered them to Ronald McDonald House – Seattle, WA

This post originally appeared on the Windermere.com Blog

The Gardner Report – Q2 2020 Western Washington

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

REGIONAL ECONOMIC OVERVIEW

It appears as if the massive COVID-19 induced contraction in employment that Washington State — along with the rest of the nation — experienced this spring is behind us (at least for now). Statewide employment started to drop in March, but April was the real shock: total employment dropped almost 460,000 between March and April, a decline of 13.1%. However, this turned around remarkably quickly, with a solid increase of 52,500 jobs in May. Worthy of note is that, in May alone, Western Washington recovered 43,500 of the 320,000 jobs that were lost in the region the prior month. Although it is certainly too early to categorically state that we are out of the woods, the direction is positive and, assuming we respect the state’s mandates regarding social distancing and mask wearing, I remain hopeful that Washington will not have to re-enter any form of lockdown.

HOME SALES

- There were 17,465 home sales during the second quarter of 2020, representing a drop of 22.2% from the same period in 2019, but 30.6% higher than in the first quarter of this year.

- The number of homes for sale was 37% lower than a year ago, but was up 32% compared to the first quarter of the year.

- Given COVID-19’s impacts, it’s not surprising that sales declined across the board. The greatest drops were in Whatcom and King counties. The smallest declines were in Grays Harbor and Cowlitz counties.

- Pending sales — a good gauge of future closings — rose 35.7% compared to the first quarter of the year, suggesting that third quarter closings will grow as well.

HOME PRICES

- Home-price growth in Western Washington rose by a relatively modest 3.5% compared to a year ago. The average sale price in the second quarter was $559,194.

- Compared to the same period a year ago, price growth was strongest in Grays Harbor County, where home prices were up 14.3%. Clallam County also saw a double-digit price increase.

- It was interesting to note that prices were up a significant 6.6% compared to the first quarter. This suggests that any concern regarding negative impacts to home values as a function of COVID-19 may be overblown.

- I will be watching for significant price growth in less urbanized areas going forward. If there is, it may be an indication that COVID-19 is affecting where buyers are choosing to live.

DAYS ON MARKET

- The average number of days it took to sell a home in the second quarter of this year matched the second quarter of 2019.

- Across the entire region, it took an average of 40 days to sell a home in the second quarter. I would also note that it took an average of 14 fewer days to sell a home than in the first quarter of this year.

- Thurston, King, Pierce, and Snohomish counties were the tightest markets in Western Washington, with homes taking an average of only 17 days to sell. All but two counties, Grays Harbor and Cowlitz, saw the length of time it took to sell a home drop compared to the same period a year ago.

- Market time remains well below the long-term average across the region. This is due to significant increases in demand along with the remarkably low level of inventory available.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

What a difference a quarter makes! Given that demand has reappeared remarkably quickly and interest rates remain historically low, it certainly remains a seller’s market and I don’t expect this to change in the foreseeable future.

The overall housing market has exhibited remarkable resilience and housing demand has rebounded faster than most would have expected. I anticipate demand to remain robust, but this will cause affordability issues to remain as long as the new construction housing market remains muted.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link